The first time in history this is happening in India

What is Jim Buying?

A restraint of trade and why commodity prices are cheap

Looking to learn from one of the greats – GOAT!

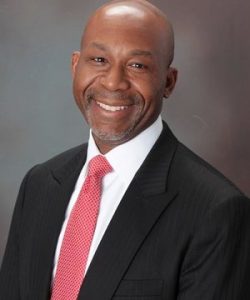

This episode’s guest: Jim Rogers – The Investment Biker

NEW! DOWNLOAD THE AI GENERATED SHOW NOTES (Guest Segment)

Jim Rogers, a native of Demopolis, Alabama, is an author, financial commentator, adventurer, and successful international investor. He has been frequently featured in Time, The Washington Post, The New York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The Financial Times, The Business Times, The Straits Times and many media outlets worldwide. He has also appeared as a regular commentator and columnist in various media and has been a professor at Columbia University.

Jim Rogers, a native of Demopolis, Alabama, is an author, financial commentator, adventurer, and successful international investor. He has been frequently featured in Time, The Washington Post, The New York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The Financial Times, The Business Times, The Straits Times and many media outlets worldwide. He has also appeared as a regular commentator and columnist in various media and has been a professor at Columbia University.

After attending Yale and Oxford University, Rogers co-founded the Quantum Fund, a global-investment partnership. During the next 10 years, the portfolio gained 4200%, while the S&P rose less than 50%. Rogers then decided to retire – at age 37. Continuing to manage his own portfolio, Rogers kept busy serving as a full professor of finance at the Columbia University Graduate School of Business, and, in 1989 and 1990, as the moderator of WCBS’s ‘The Dreyfus Roundtable’ and FNN’s ‘The Profit Motive with Jim Rogers’.

In 1990-1992, Rogers fulfilled his lifelong dream: motorcycling 100,000 miles across six continents, a feat that landed him in the Guinness Book of World Records. As a private investor, he constantly analyzed the countries through which he traveled for investment ideas. He chronicled his one-of-a-kind journey in Investment Biker: On the Road with Jim Rogers. Jim also embarked on a Millennium Adventure in 1999. He traveled for 3 years on his round-the-world, Guinness World Record journey. It was his 3rd Guinness Record. Passing through 116 countries, he covered more than 245,000 kilometers, which he recounted in his book Adventure Capitalist: The Ultimate Road Trip.

Check this out and find out more at: http://www.interactivebrokers.com/

Follow @andrewhorowitz

Looking for style diversification? More information on the TDI Managed Growth Strategy – HERE

Stocks mentioned in this episode: (SLV), (GLD), (CMG), (DOW), (KSS), (KOSS), (DHI), (SHW)

Our TOPPODCAST Picks

Our TOPPODCAST Picks  Stay Connected

Stay Connected