Patrick Schmid has a Phd in Economics and is the Vice President of RiskStream Collaborative (previously known as the RiskBlock Alliance). In this fascinating episode he provides an expert opinion and process for calculating ROI for blockchain applications. This is a must listen episode for anyone looking to develop blockchain solutions and need a functioning model to be able to calculate expected ROI.

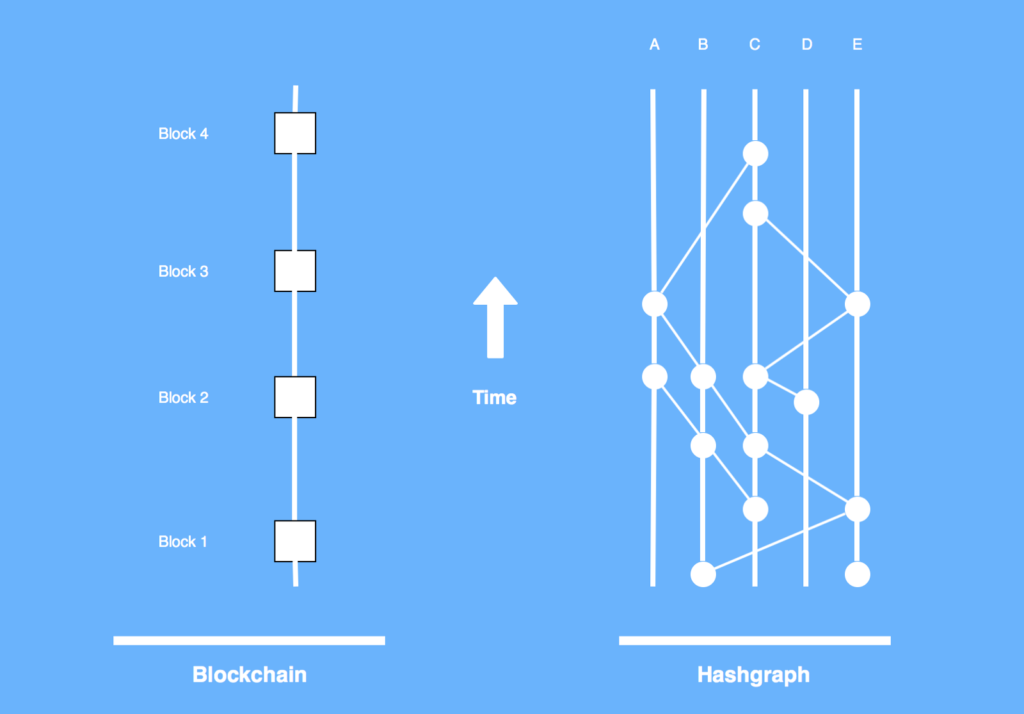

What is blockchain?

Patrick proposed two definitions:

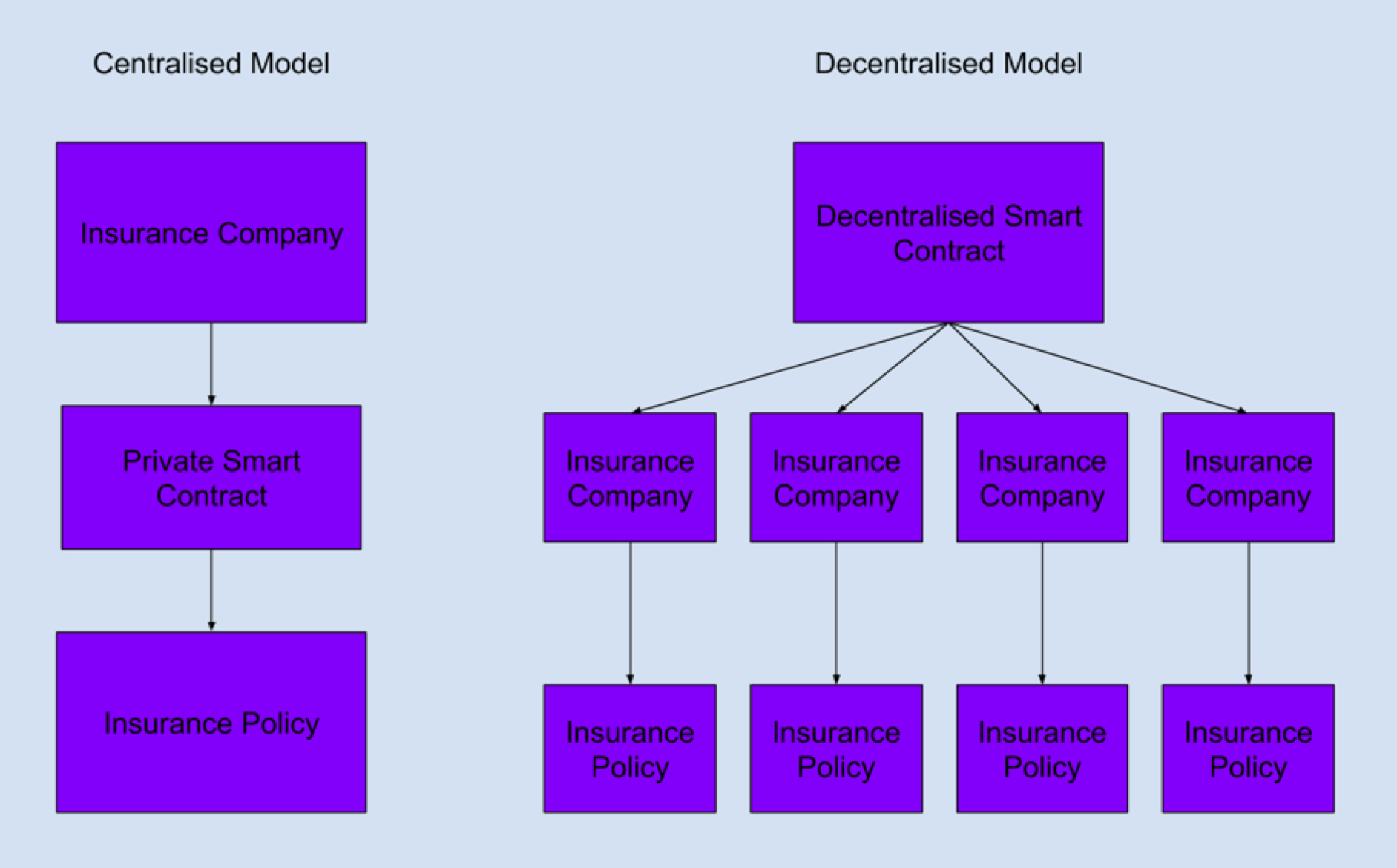

Formal definition

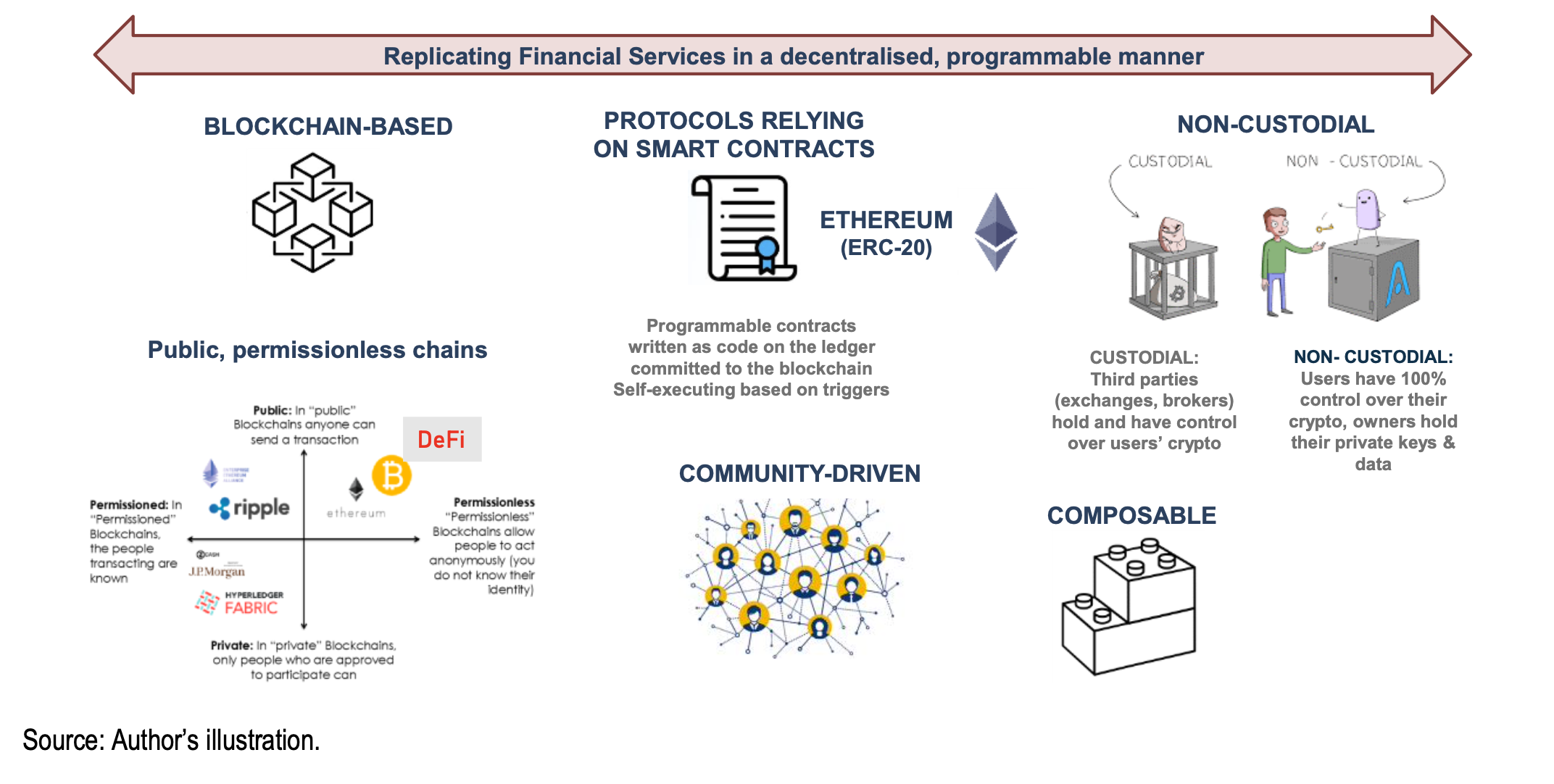

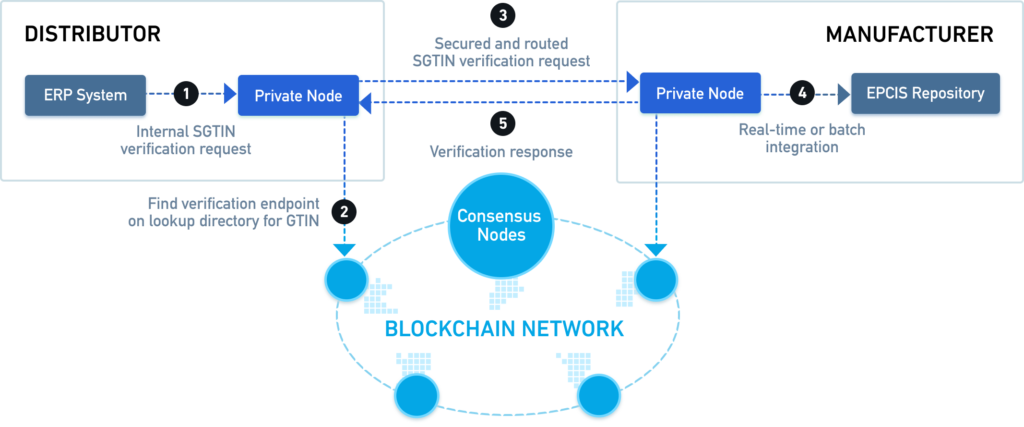

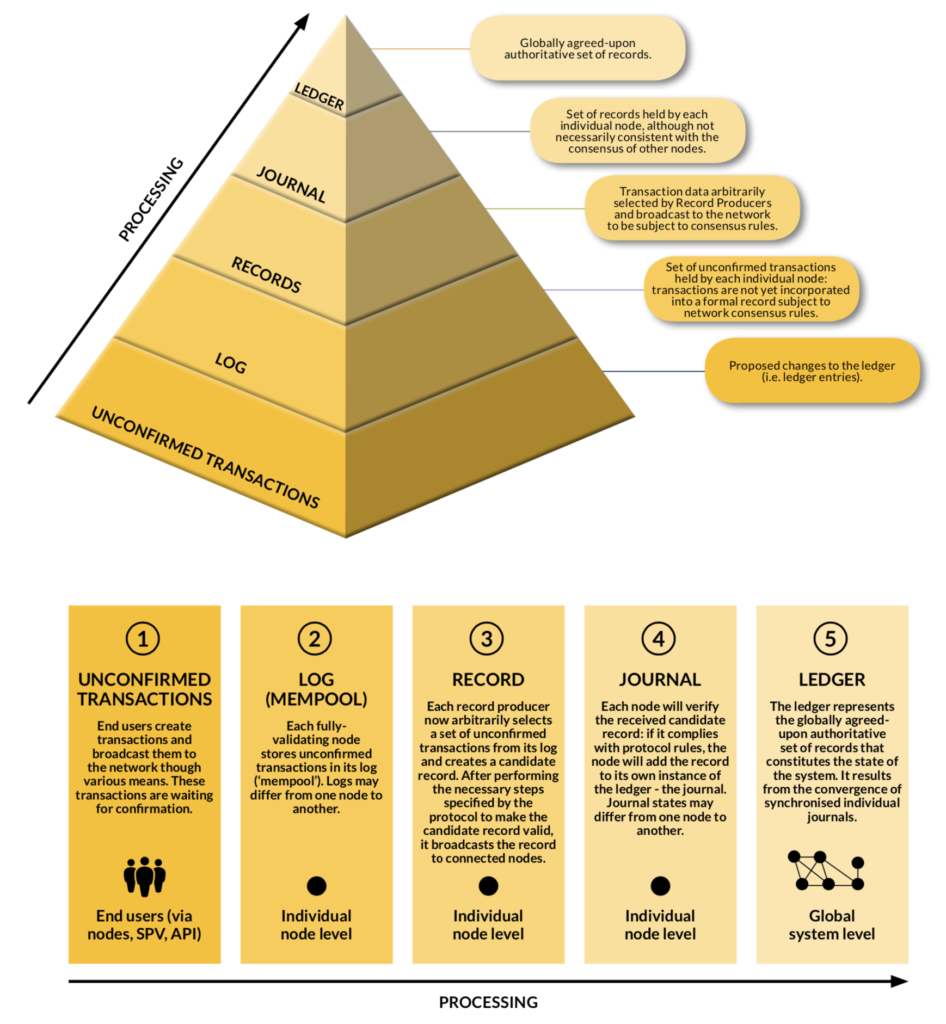

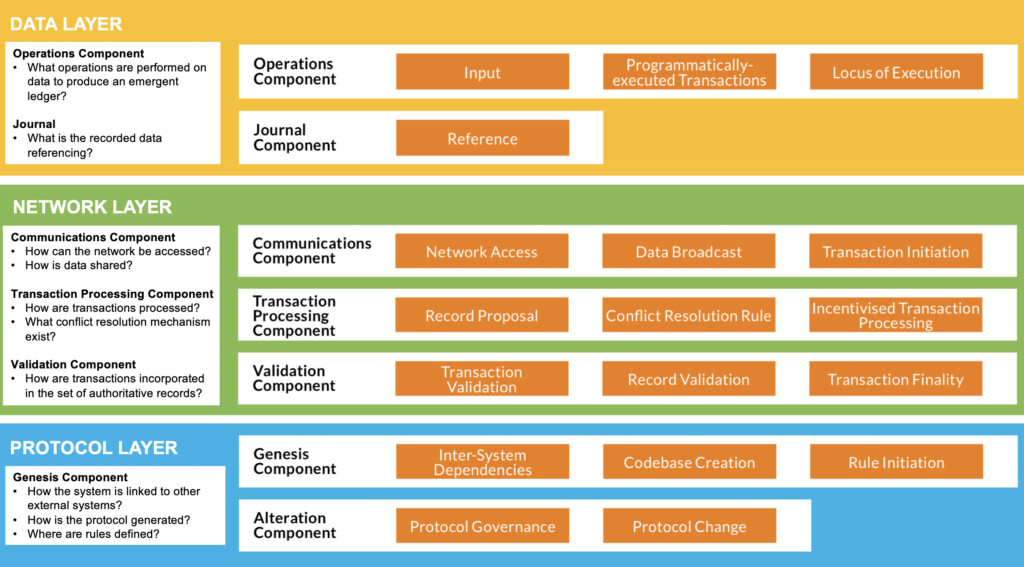

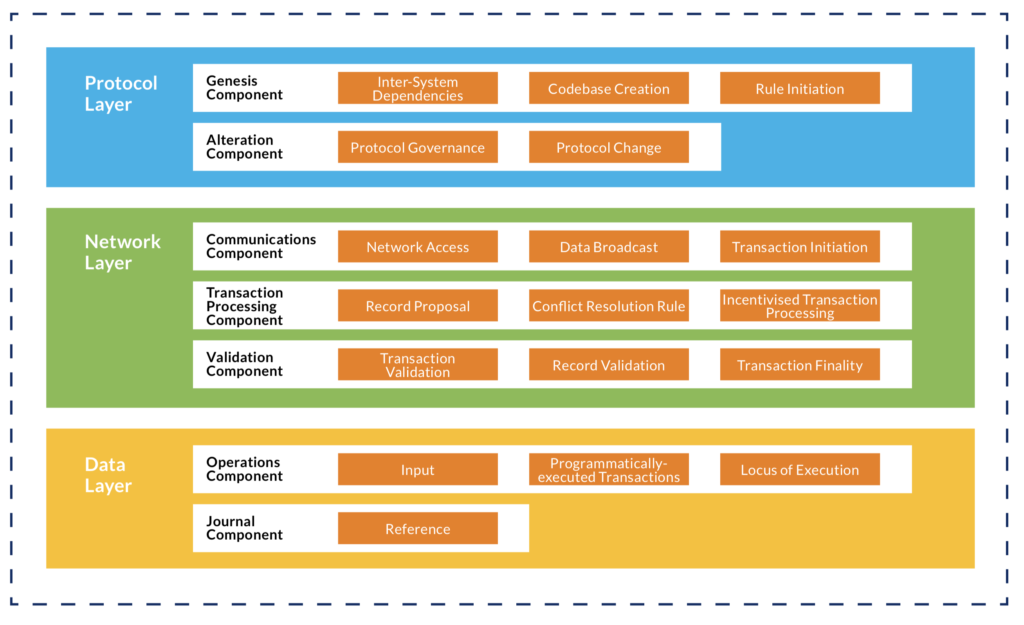

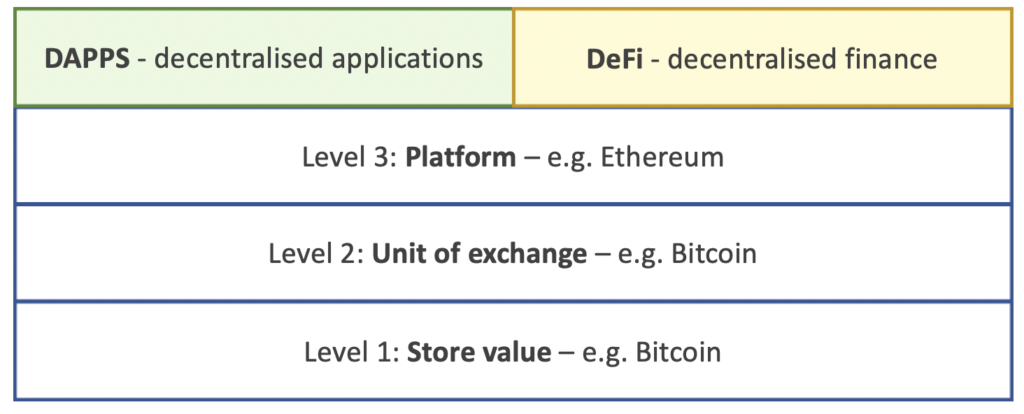

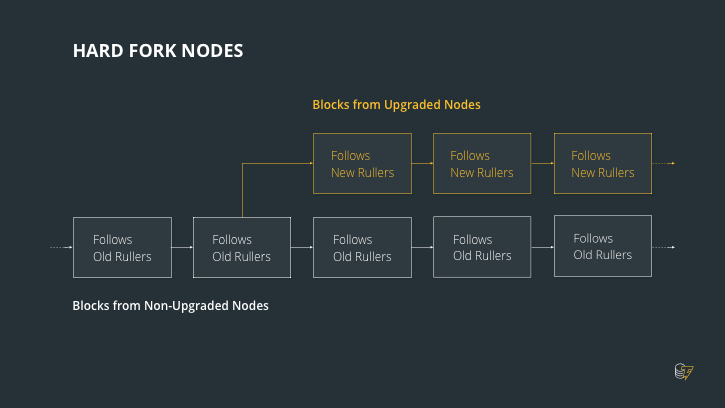

Blockchain is a distributed ledger that maintains a constantly growing list of chronologically added records in the form of blocks. Within each block the data (e.g. transactional data or smart contracts) is confirmed and verified through this decentralised consensus process. This process removes the need for an intermediary to be involved in verifying and confirming transactions. Therefore, it establishes trust without the usage of a centralised authority. This is why, blockchain is often referenced at the trust machine. It is the decentralisation of trust where the data was once stored in one location and the trust was provided by one party. With blockchain the data is broadcast to all parties within network and the entire community is providing the consensus through the protocol itself.

Informal definition

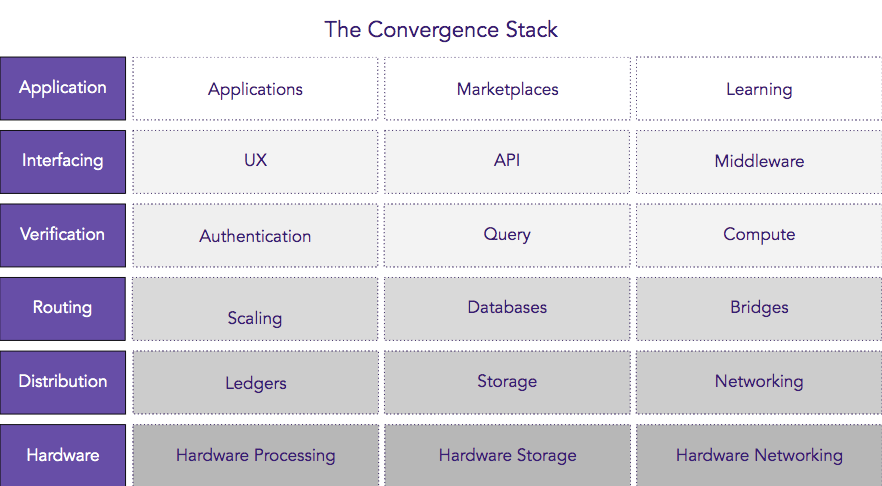

Blockchain basically meshes the network with database/distributed database/ledger through encryption to provide advancements in ecommerce or transactions, or computing via smart contracts.

What is the Institute & how did its blockchain initiative start?

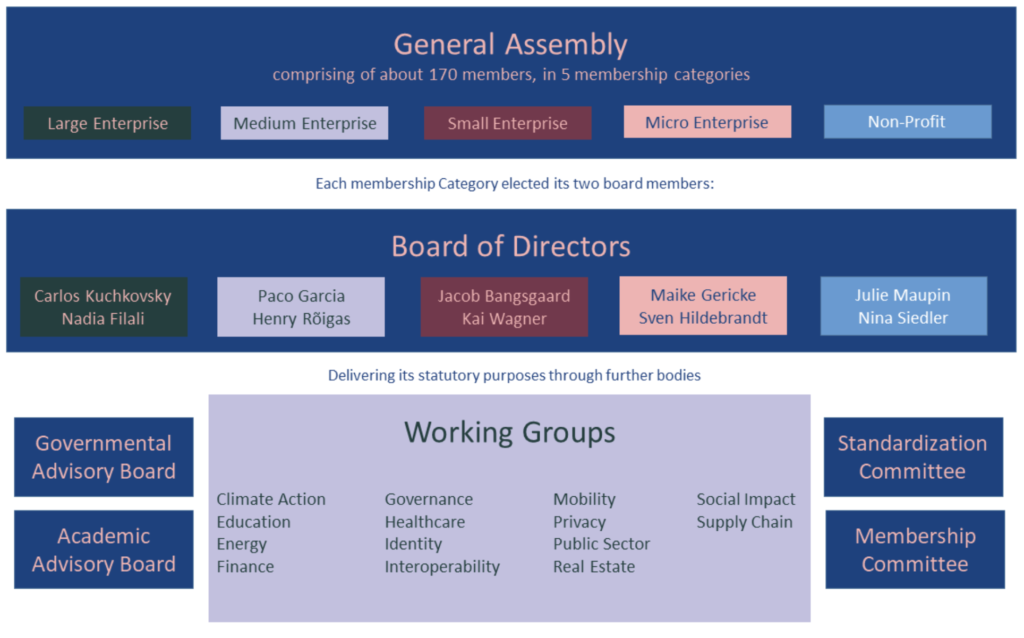

The Institute is a 501c3 not-for-profit that was set up over a hundred years ago out of the Wharton School at the University of Pennsylvania. The Institute provides knowledge-based solutions with the goal to make the risk management, in the insurance industry, more efficient for industry participants and consumers.

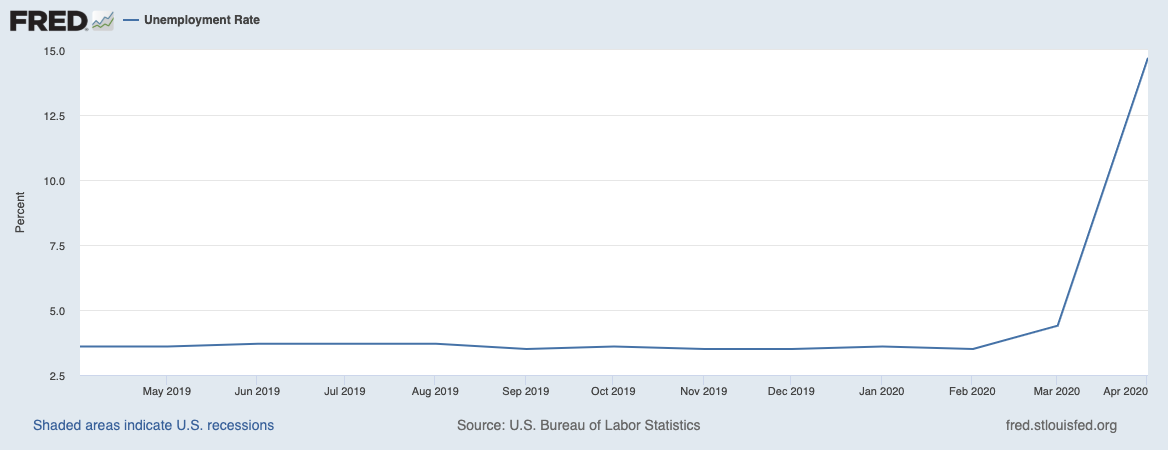

The Institute came across blockchain through their existing research when Patrick was leading their enterprise research whose goal was to provide some market insights and trends. Some of the early trends coming out of this research was that the insurance industry was going to continue to undergo employment changes. For example, careers in analytics were going to continue growing whilst traditional careers were expected to either remain stagnant or shrink.

Patrick had developed an early personal interest in bitcoin, cryptocurrency and blockchain. In 2015 Patrick discovered smart contracts and R3’s emerging banking consortium. It became apparent that there was a need to develop a thought on blockchain for the insurance space. After some extensive research and discussions with numerous players in the space, Patrick made some recommendations to the senior management team to consider starting a blockchain insurance consortium in 2016. He felt that a not for profit would be perfectly suited to provide the network for the insurance industry. The Institute’s Board, which represents 40 – 50 CEOs that represent 60-70% of domestic insurance premium volume, reviewed the recommendations and supported them. Now RiskStream is not only doing this in the P&C industry but also expanding to Canada by working with LIMRAto start working on the life and annuities as well.

What is RiskStream Collaborative?

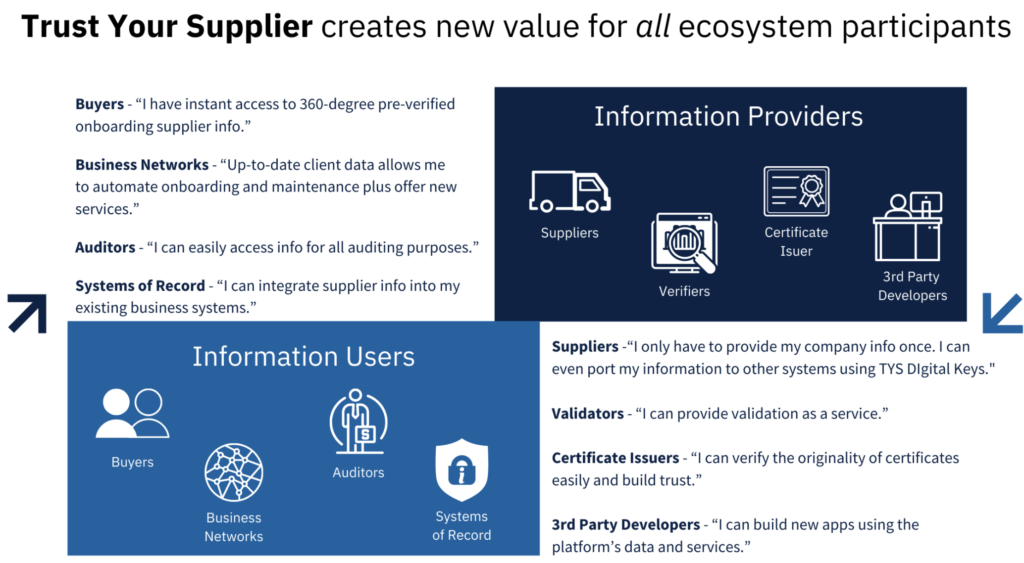

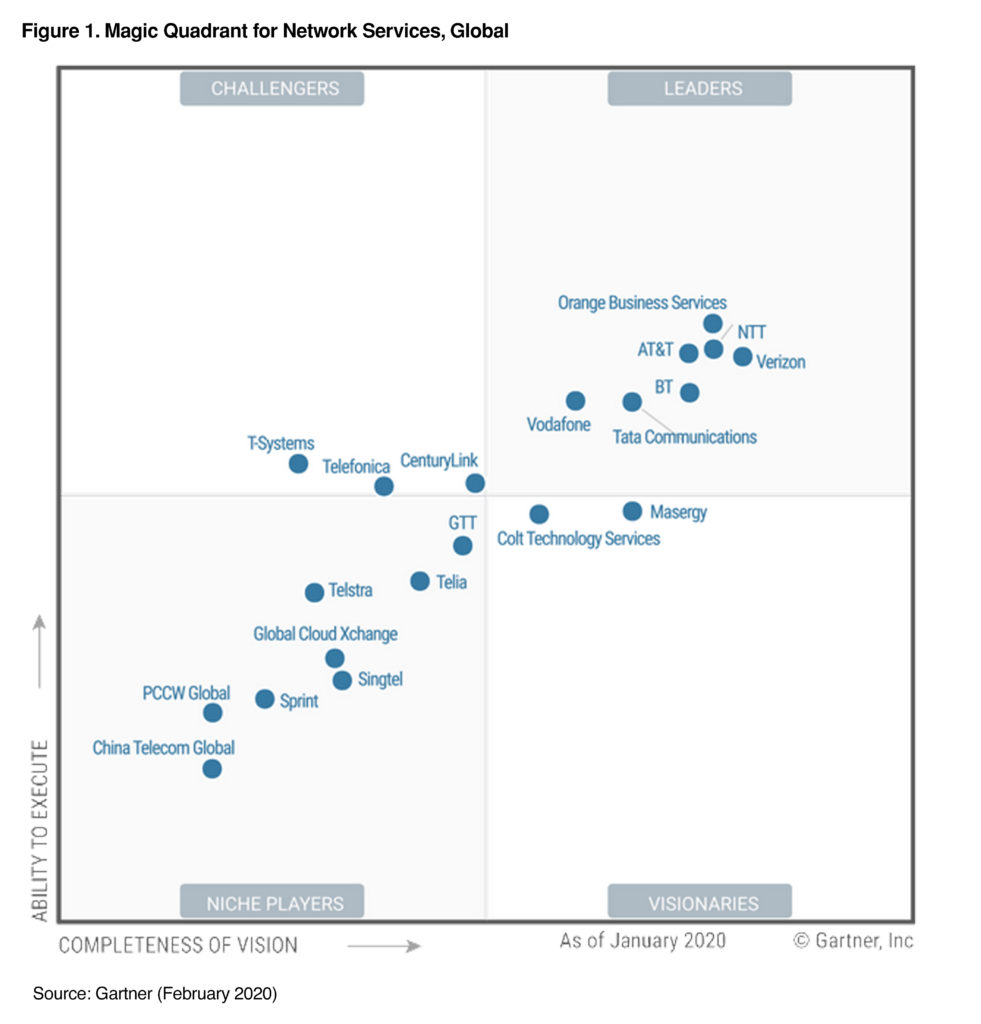

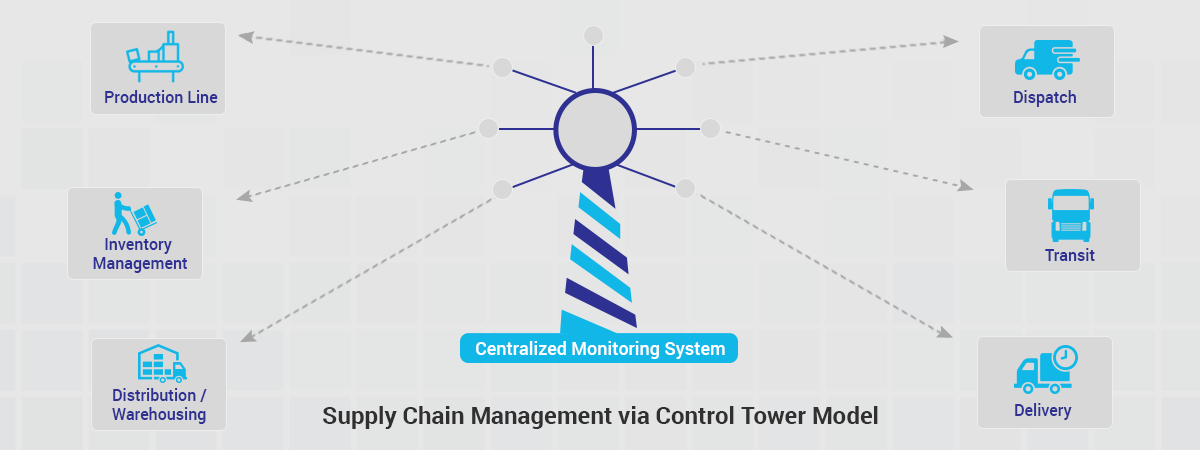

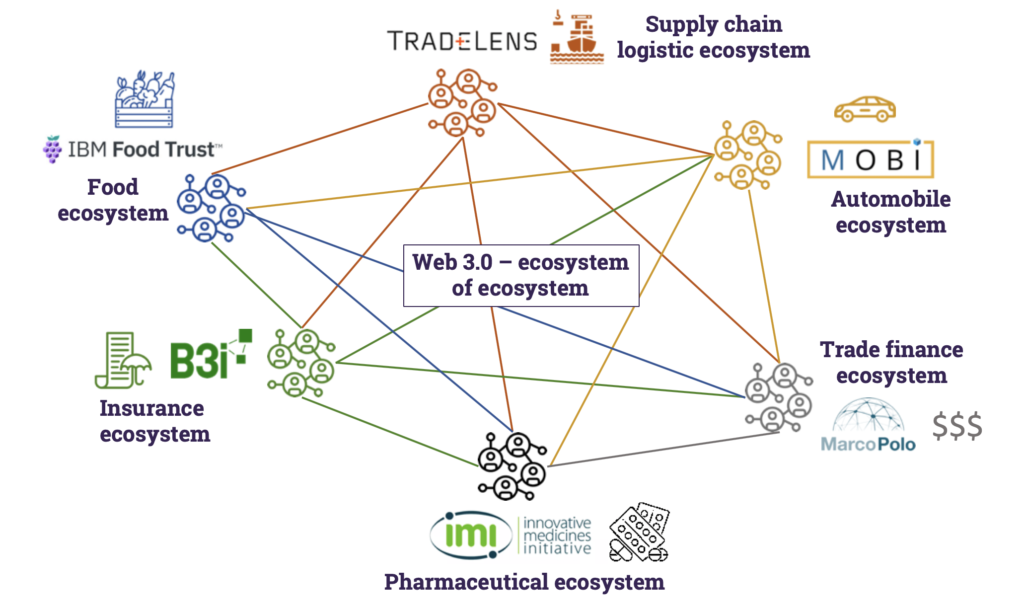

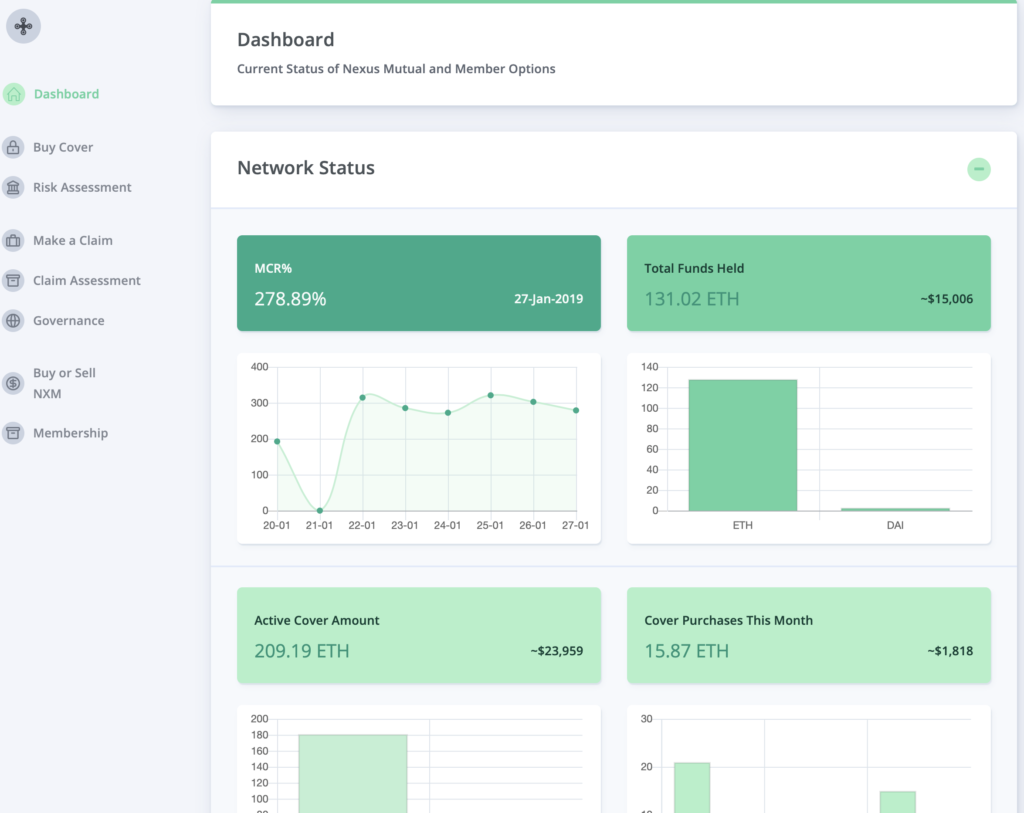

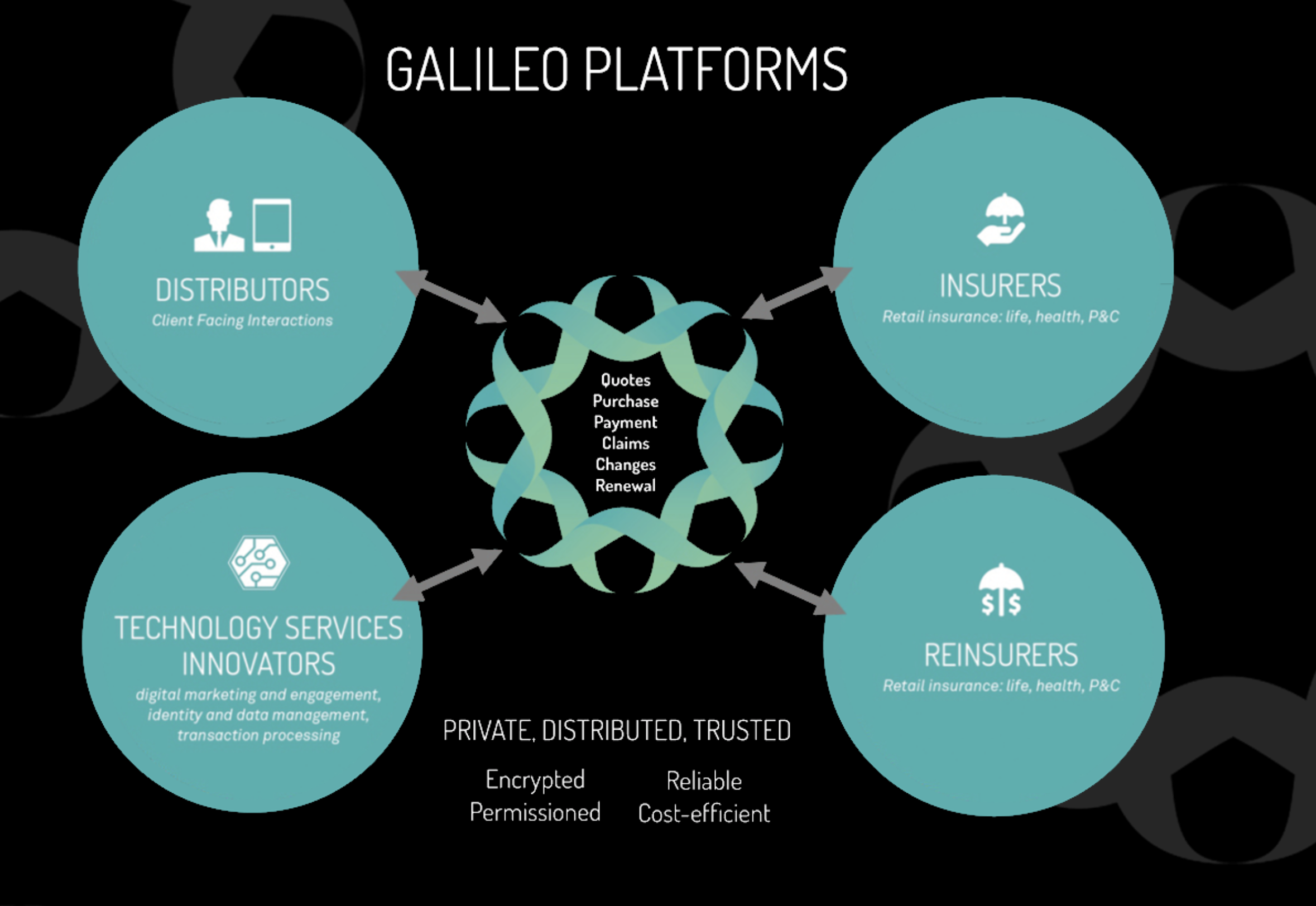

RiskStream’s perspective is that DLT (distributed ledger technology) is network driven, whilst the technology is here to answer pain points that the insurance industry faces, they feel that a non-partisan arbiter is needed to bring the industry together to design, test, implement and ultimately adopt the technology.

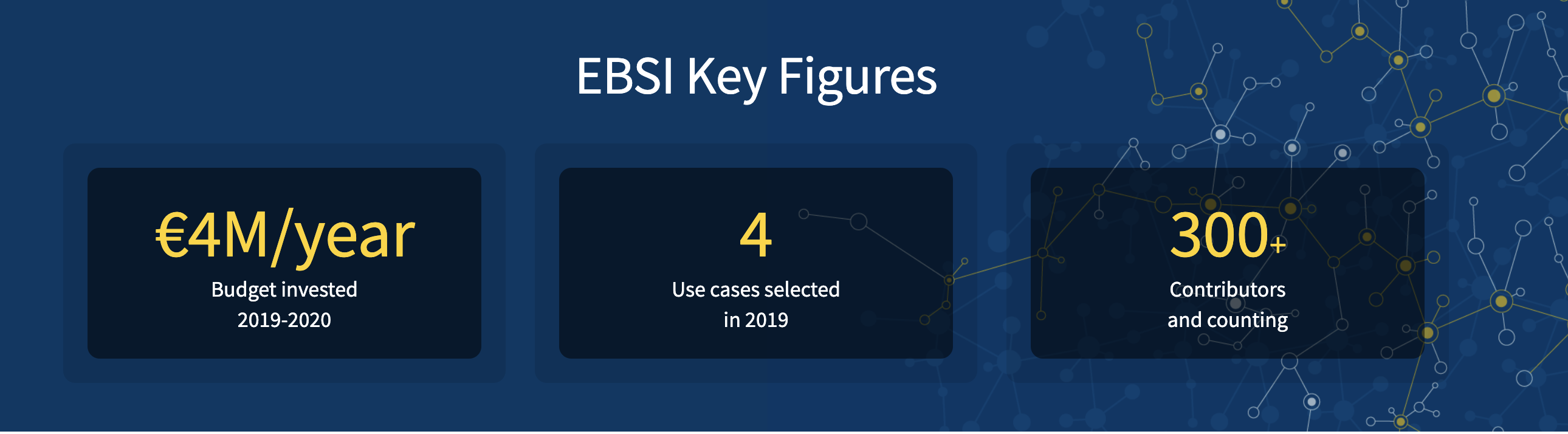

The RiskStream Collaborative was brought forth through the Institute and is designed to be that connector. RiskStream is a 501c6 not-for-profit.

Its members lead every area of what they do. They have over 40 members from carriers, distributors, reinsurers and brokers. For example, members work with RiskStream staff to design use cases on behalf of the industry. Then work with staff and service providers (e.g. Accenture and EY) to build out the canopy framework and the associated applications.

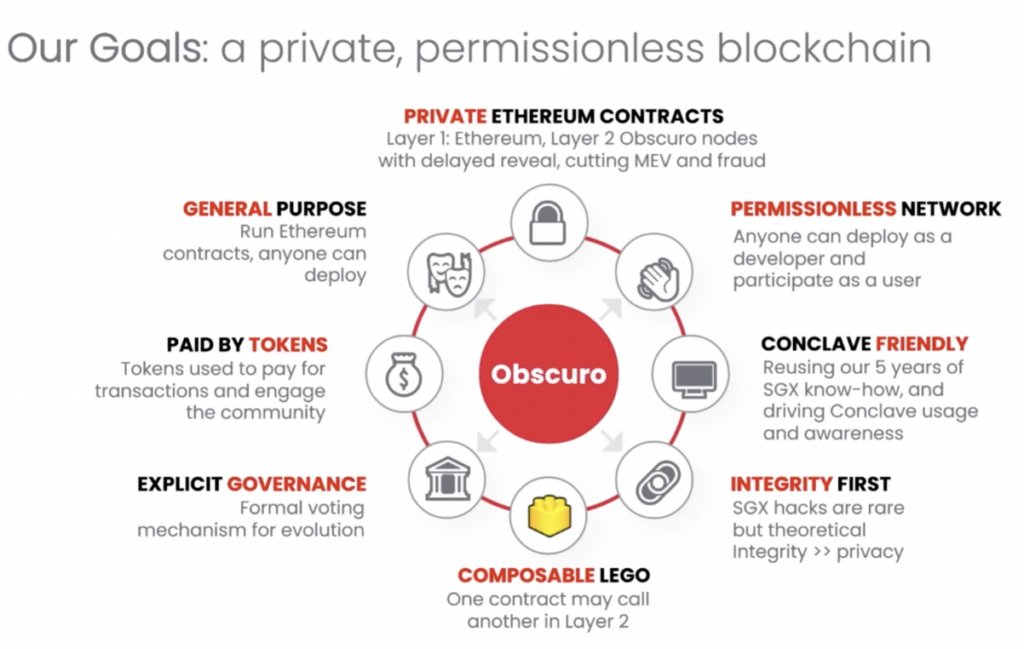

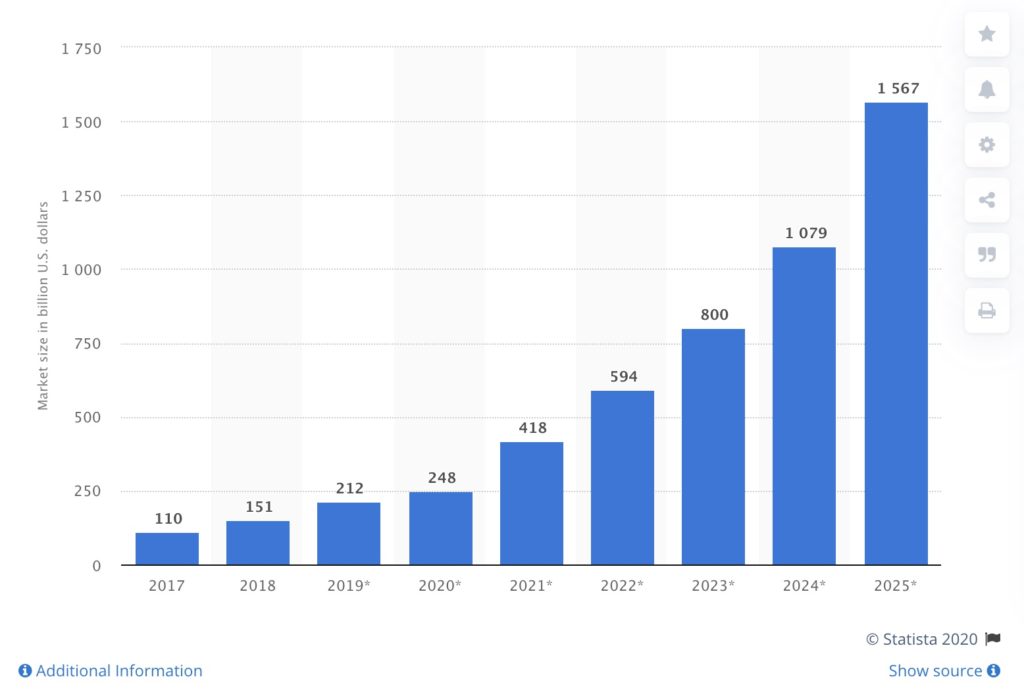

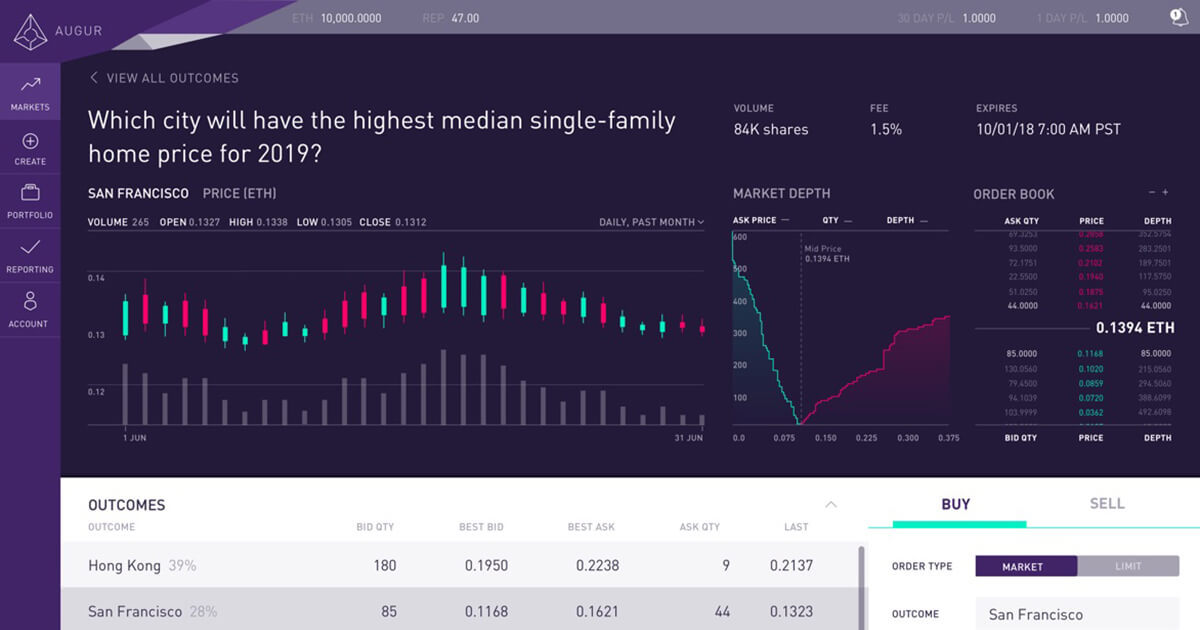

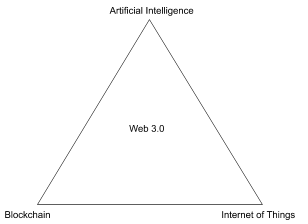

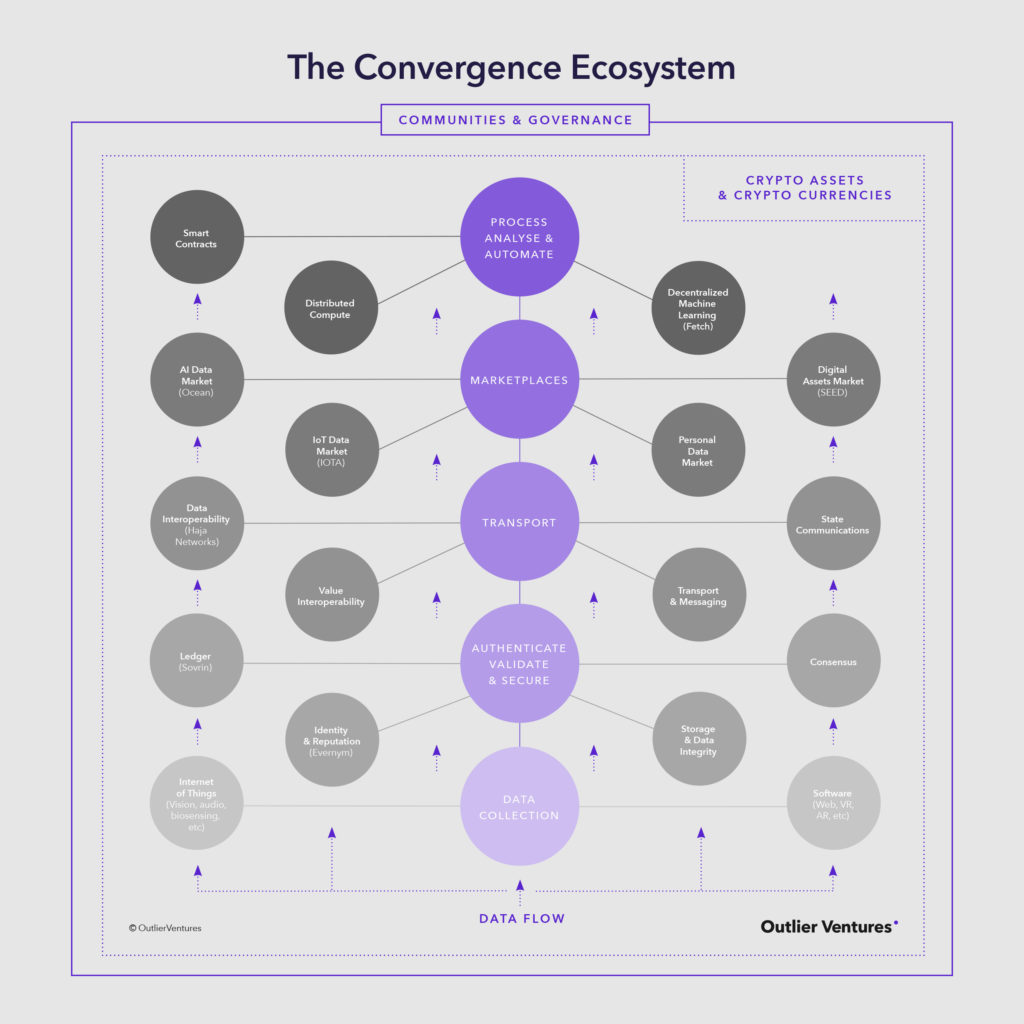

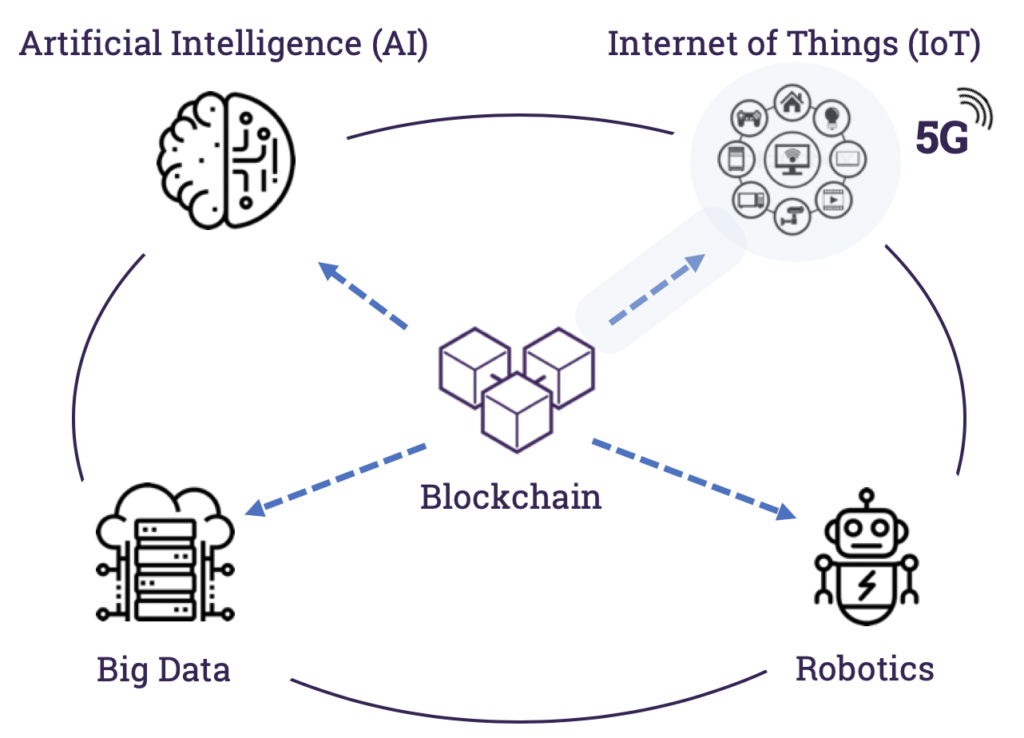

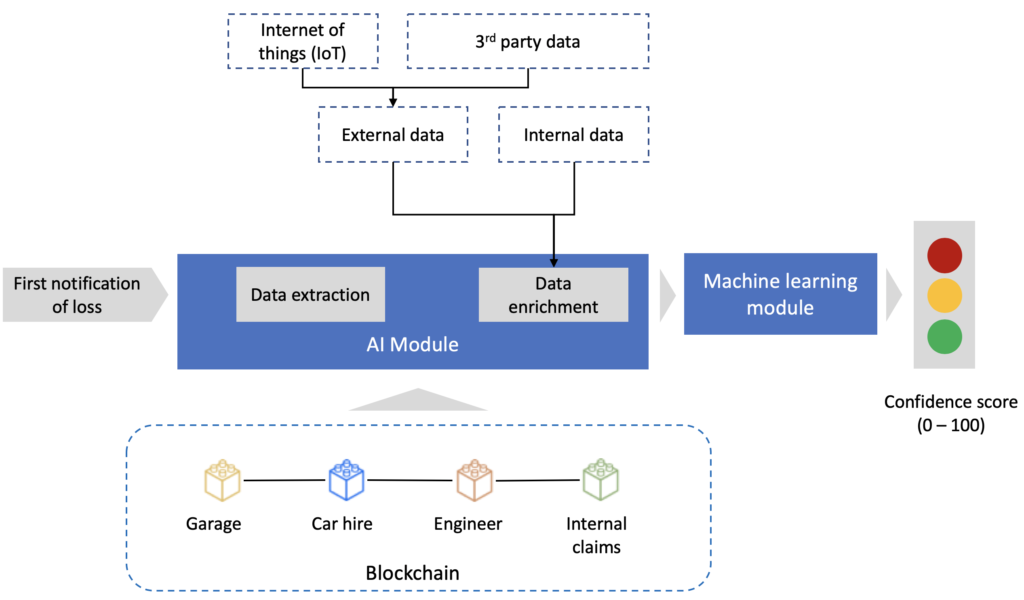

RiskStream is looking to leverage the Canopy Framework, which is built out of Corda, to connect to new and emerging technologies like IoT and AI. This is something that both RiskStream’s members demand and the industry at large. Due to these reasons they decided to rebrand the RiskBlock Alliance to RiskStream Collaborative in order not to be pigeonholed into solely blockchain but as a provider of industry wide solutions.

Blog – Examining the benefits of RBA Alliance’s proof of insurance and first notice of loss applications

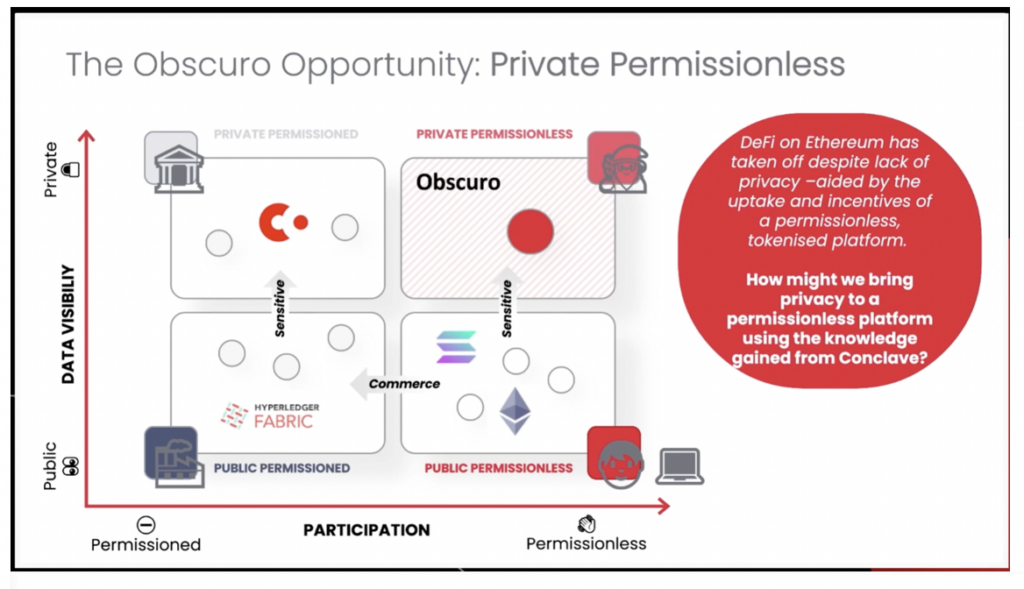

On the 5thof February, Patrick Schmid published an article entitled “Examining the benefits of RBA Alliance’s proof of insurance and first notice of loss applications”.For the last few years RiskStream has been doing a considerable amount of work on the proof of insurance and first notice of loss applications. Originally the applications where developed on Ethereum but as RiskStream’s members weren’t too comfortable to utilising a public/private Ethereum blockchain a transition was made to Corda. Requirements, use cases, and user journeys were developed for each application with the members at a very granular level over the years.

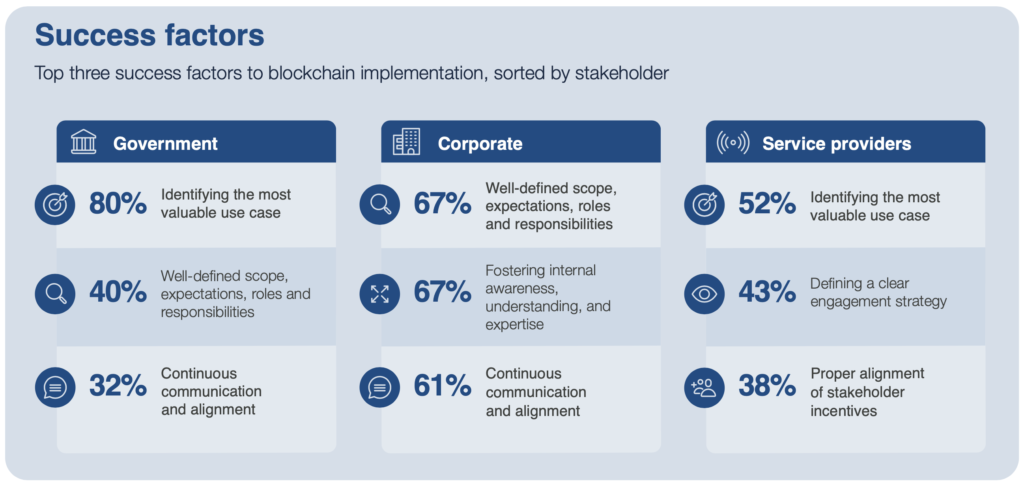

As the use cases where gearing up to launch into production the RiskStream advisory board asked what is the ROI and benefits associated with those use cases? However, it is challenging building out the ROI without the use cases being into production so a set of assumptions had to be developed in order to build the business models.

The blog post was written to provide a starting point that would help the industry build use cases and ROI models associated to them.

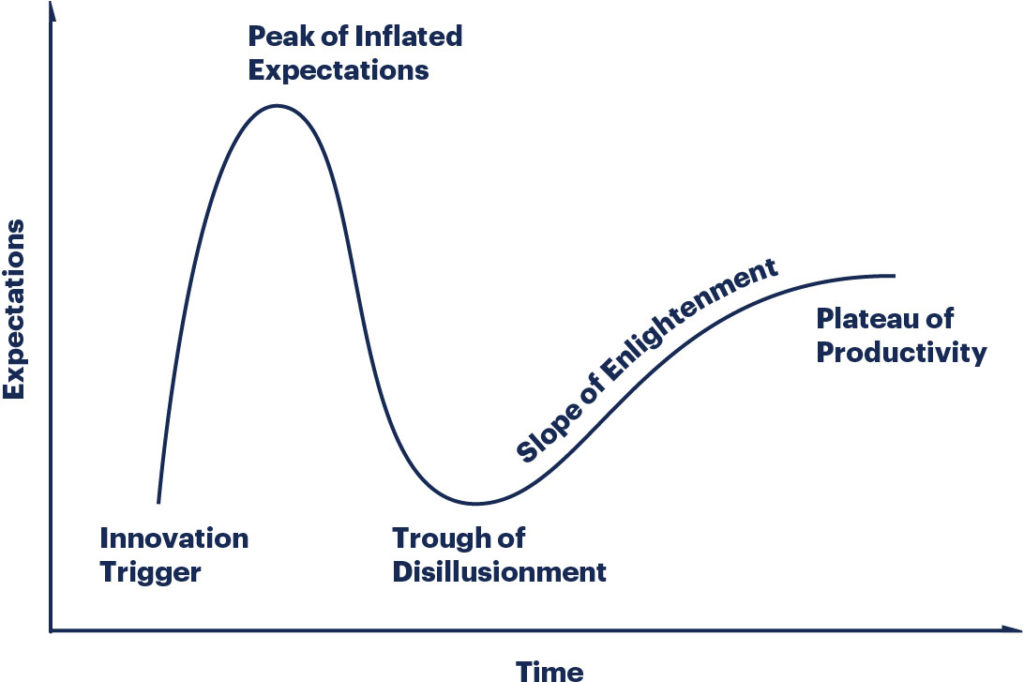

A clear need for ROI on blockchain

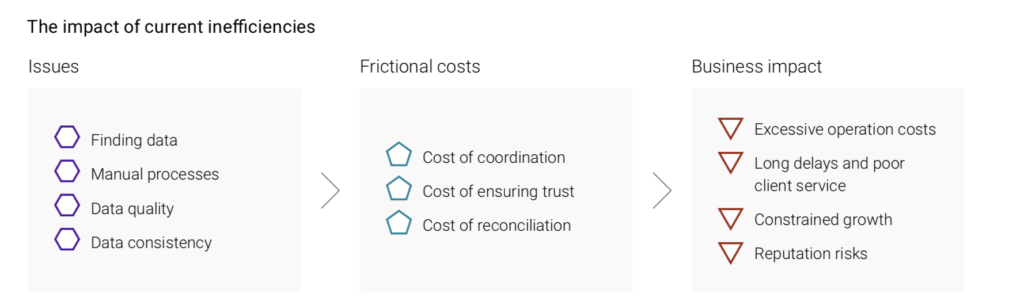

Too often up to now we get statements similar to the one from Patrick’s post “From an insured’s perspective, industry use of blockchain may enhance the customer experience, improve affordability, provide a means for greater product innovation and allow for faster entry into emerging markets. From an insurer’s perspective, use of blockchain may lower costs, ease data retrieval, simplify processes, offer new products, combat fraud and lower regulatory burdens.” This is something that is often mentioned by blockchain advocates but measurable evidence of that has been limited. We asked Patrick why he felt that was the case? He had a number of answers to that question:

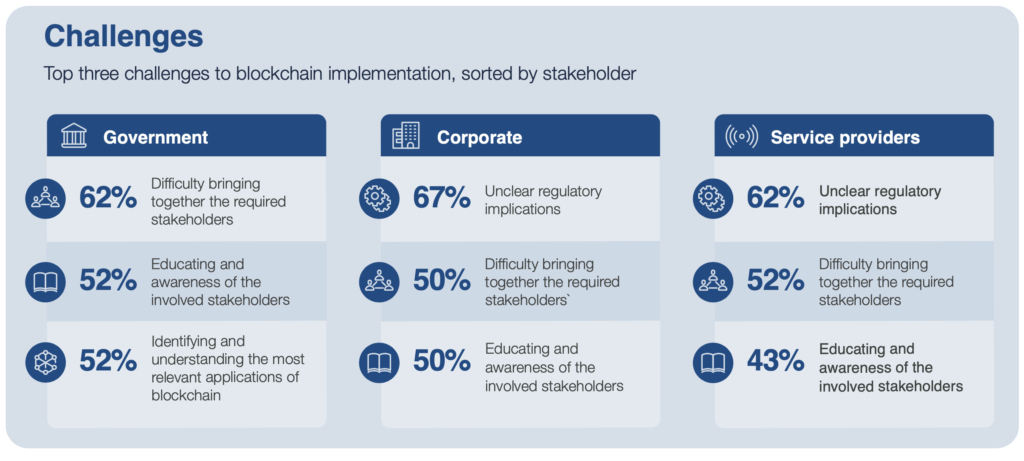

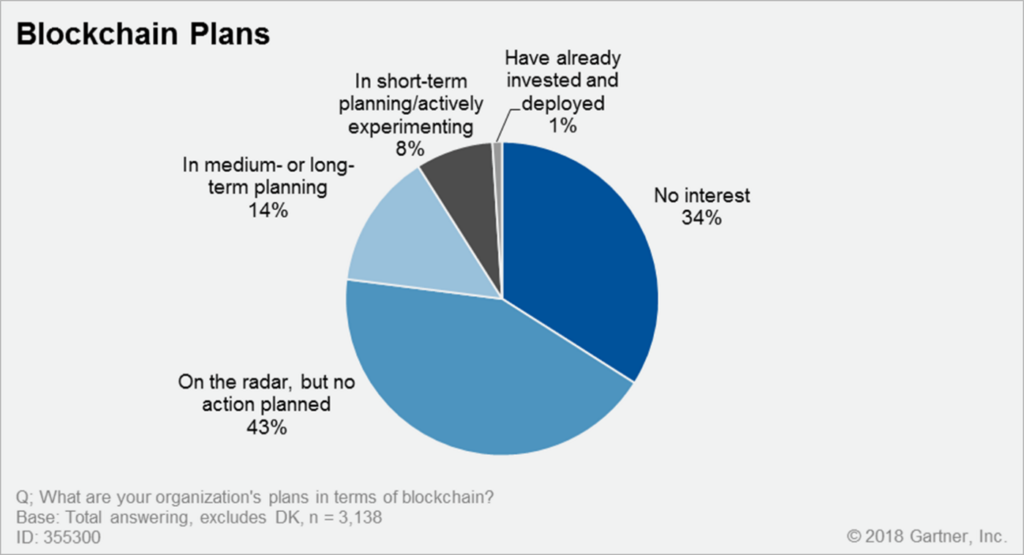

- Blockchain is still a nascent technology. It is challenging to quantify because whilst there is a lot of news about the subject there is much actual use of it up to now.

- Much of the savings that blockchain can provide is around operational efficiency and/or customer experience related which are areas that are tough to measure.

- Blockchain is a network-based technology. As it isn’t a technology that can be used on your own you have to make assumptions about the network size

Patrick is optimistic that this will change as canopy’s two use cases are coming into production within June 2019 and have RiskStream’s members using it by late summer 2019 for proof of insurance and first notice of loss.

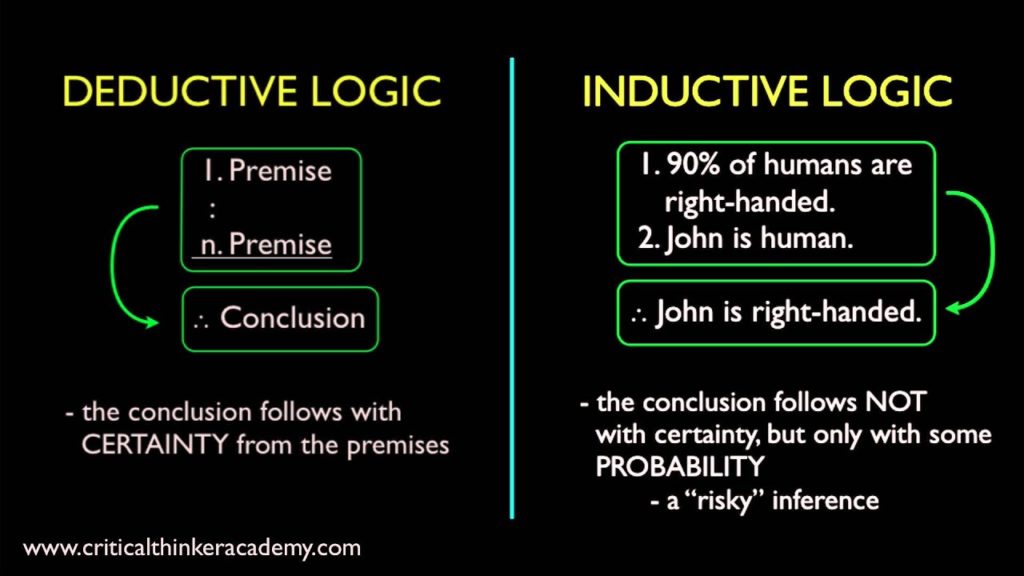

In his blog he makes it clear that in calculating ROI he only looked at known measurable impacts. He didn’t look at unknown measurable impacts, known unmeasurable impacts, and unknown unmeasurable impacts.

ROI on proof of insurance

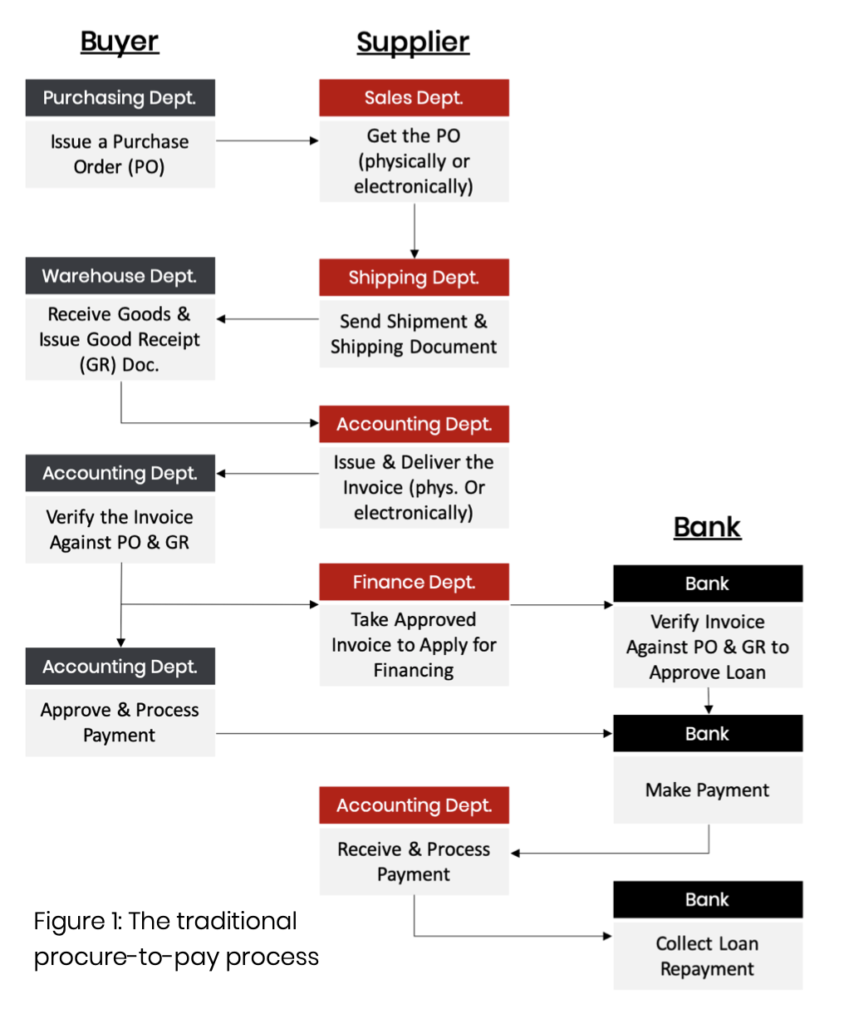

Proof of insurance is required in a number of circumstances and often leads to costs for insurers as they field calls, exchange information, verify coverage and provide record-keeping.

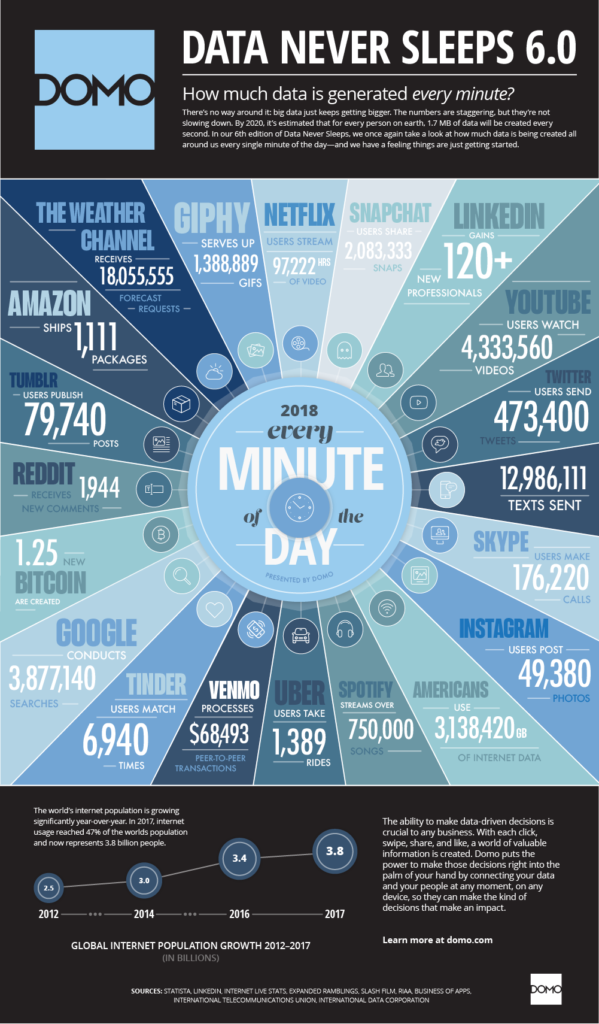

In the United States alone, approximately 26.4 million people are involved in an auto traffic stop annually, and police report over 6.3 million auto crashes in a given year. Each of these instances, which total 32.7 million occurrences, involves auto proof of insurance validation — and likely represents a small portion of total auto-related proof of insurance verifications in the US.

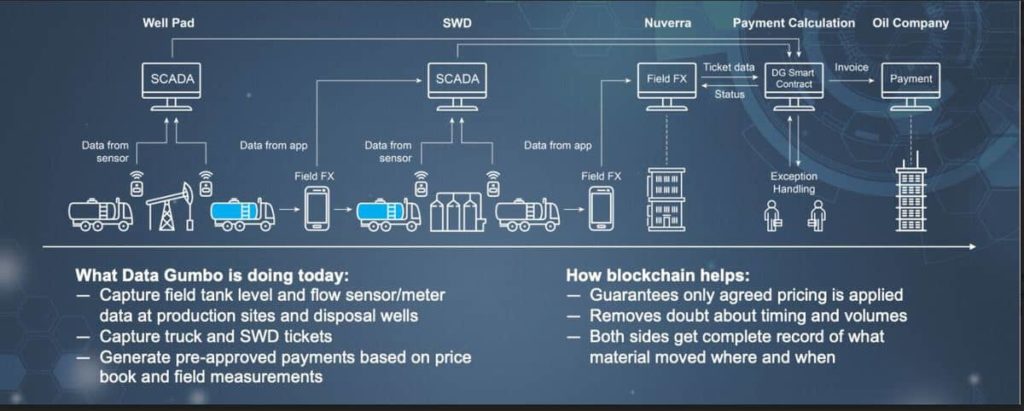

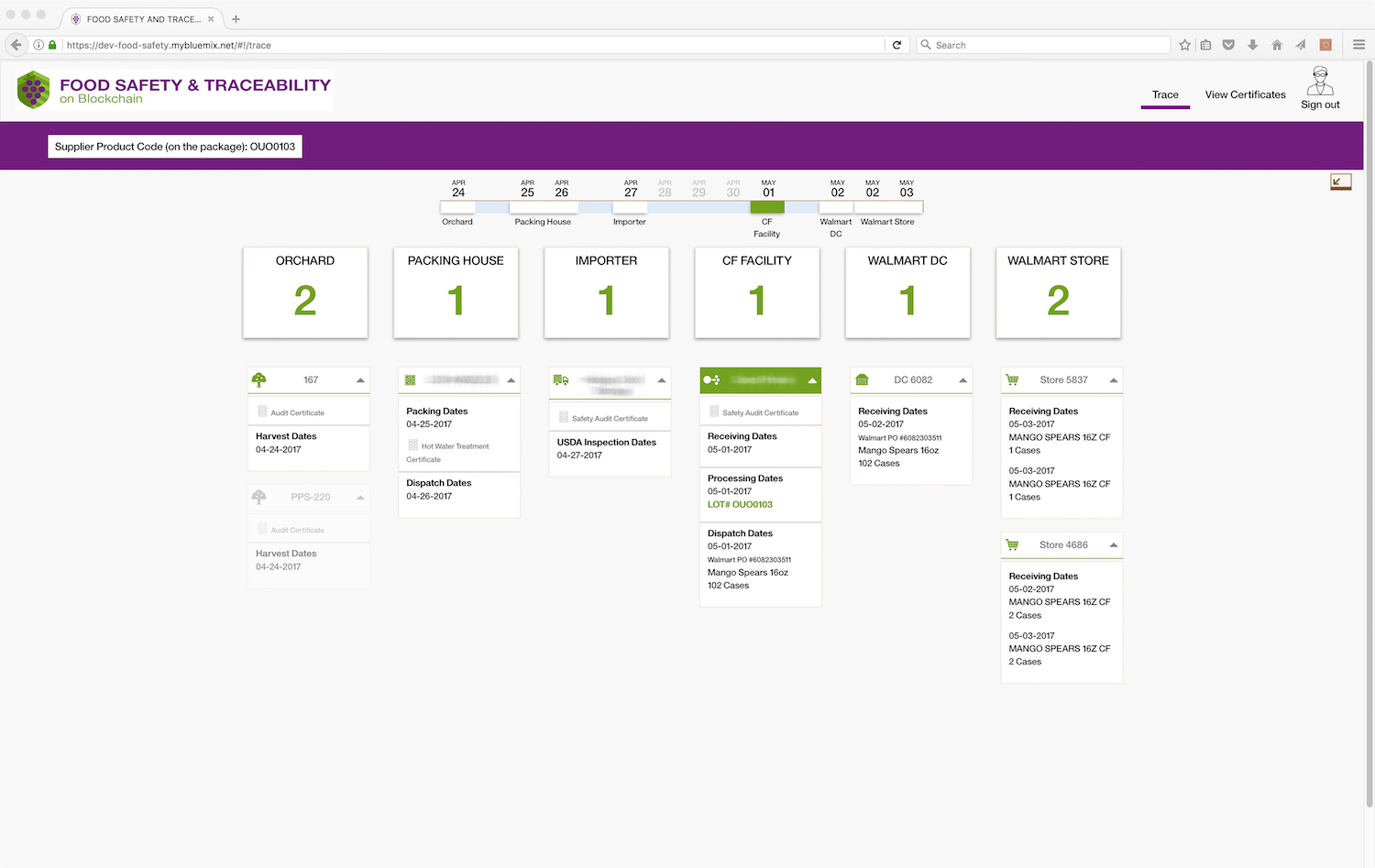

Distributed ledger technology, like blockchain, canreallyhelp ease this process on consumers, agents/brokers, carriers and other interested parties by providing a single source of truth and a permissioned means to transferor verifyinsurance informationcoverageacross various parties.

If a company is involved in a network, like RiskStream, a DLT-based application could help the companies involved in the consortium to share data, cutting down on paper-related costs or data storage and the costs incurred by complying with state-based insurance verification systems as many of these systems mandate submission of complex data feeds. The hope is that longer term, if adopted by a large network, the proof of insurance use case could cut down on uninsured motorists, which represent about 13% of driversin the United States.This is a costs are passed down to insureds through their own coverage. The proof of insurance application may also have impacts on the customer experience by streamlining activities and easing the data sharing for the consumer.

Three cost reductions were identified with proof of insurance for calculating ROI:

- Costs reductions associated with the need to store image files for use within existing mobile apps

- Reducing costs of providing paper Insurance cards

- Reduced costs of complying with state run insurance verification systems

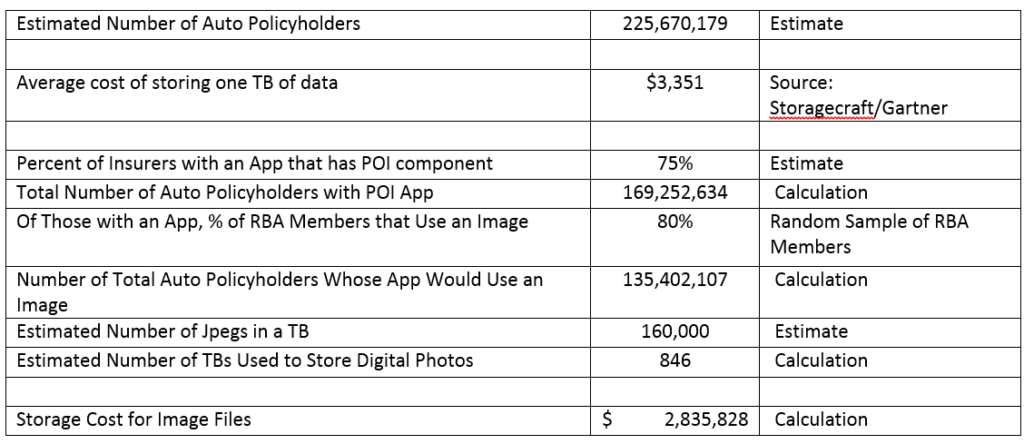

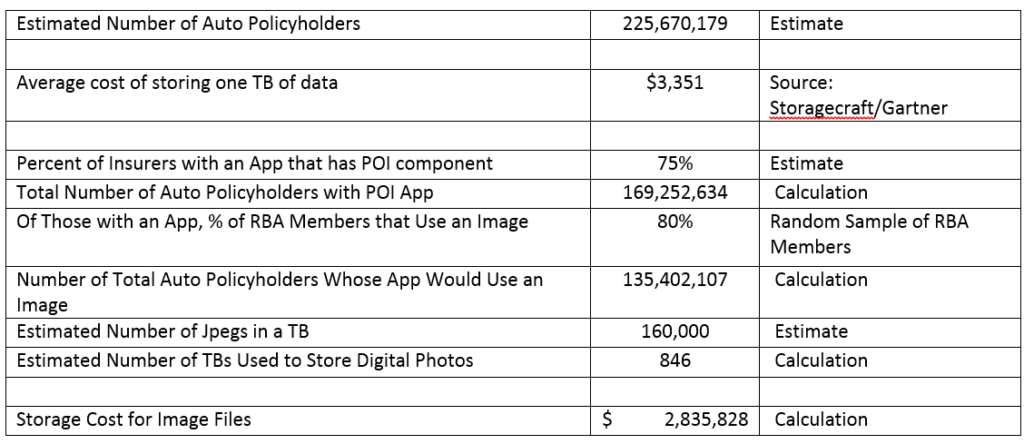

Costs reductions associated with the need to store image files for use within existing mobile apps

Today many insurers have digital images of their insurance provided paper card which they share via a mobile application.

There is a cost to store that image file. There is a cost to insurers to store these photographs within their systems. An important note is we assume the images are stored on premises due the security aspects associated with the proprietary data including in an insurance card.

According to StorgeCraft (using a report by Gartner), the average cost of storing one TB of data in-house is $3,351. This number is supported in other research. It includes items like base cost, redundancy and backup, facilities and power, maintenance, migration and management.

Total estimated storage costs comes up to $2,835,827

Proof of insurance – storage costs for image files

Source: https://medium.com/@schmidpat/examining-the-benefits-of-riskblocks-proof-of-insurance-and-first-notice-of-loss-applications-6a9e545fb734

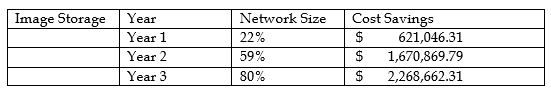

If Proof of Insurance data was standardized and exchanged through distributed ledger technology (DLT), it will transform the Proof of Insurance process (exchange of information between policyholders or presentation to a third party) by introducing a unique way to validate and securely provide proof of insurance electronically in real time. Total estimated savings of using DLT over three years are of $2,268,662

Proof of insurance – image storage costs savings

Source: https://medium.com/@schmidpat/examining-the-benefits-of-riskblocks-proof-of-insurance-and-first-notice-of-loss-applications-6a9e545fb734

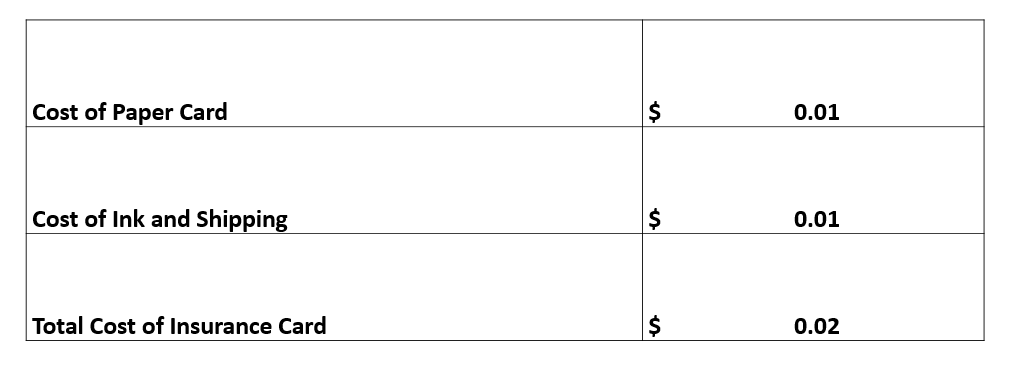

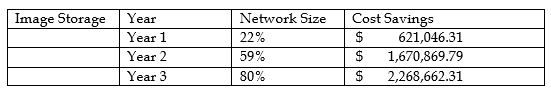

Reducing costs of providing paper Insurance cards

Auto insurance ID paper cards are issued with the policy, whether it’s a new or renewal policy. Since many auto policies are issued every six months, it’s possible that a ID card is shipped to each policyholder twice a year, and possibly more if changes are made to the auto insurance policy that trigger the issuance of new ID cards.

Proof of insurance – paper insurance cards costs

Source: https://medium.com/@schmidpat/examining-the-benefits-of-riskblocks-proof-of-insurance-and-first-notice-of-loss-applications-6a9e545fb734

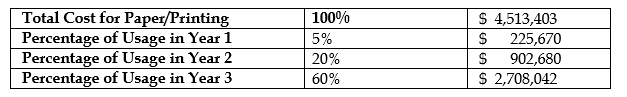

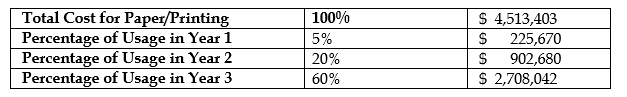

It’s assumed that the total cost of sending an insurance card is $0.02. If there are 225,670,179 insureds nationally and assume that the count of send outs is neither higher, nor lower than the insureds count, then one could simply multiply the two numbers to get the industry wide cost, which comes to $4,513,403. This implies if every company in the private passenger auto market were to do away with proof of insurance cards, there would be a $4.5 million savings.

Proof of insurance – paper insurance cards costs savings

Source: https://medium.com/@schmidpat/examining-the-benefits-of-riskblocks-proof-of-insurance-and-first-notice-of-loss-applications-6a9e545fb734

Reduced costs of complying with state run insurance verification systems

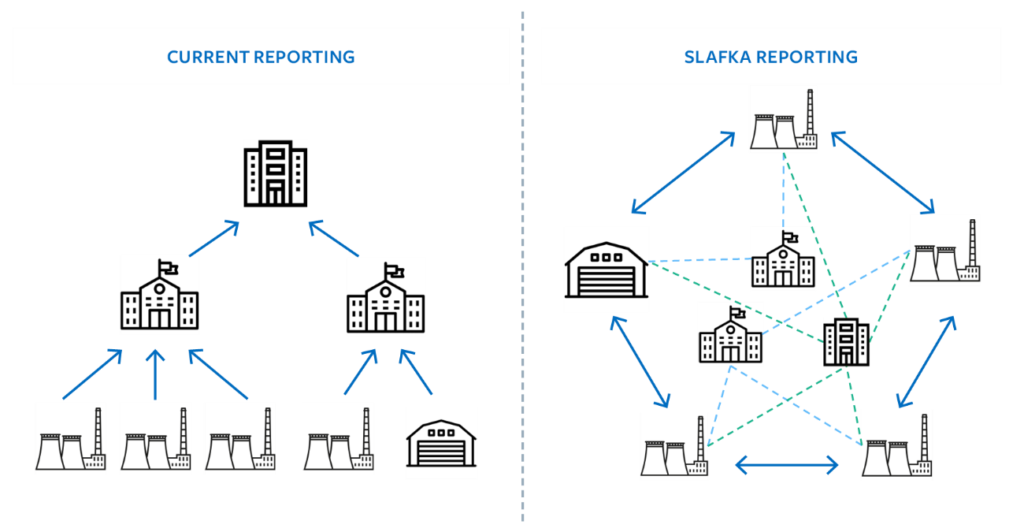

Uninsured motors problem is a big concern for various states. Certain states have uninsured motors rates as close as 25%. In order to limit those issues various states have set up insurance verification systems and have implemented insurance reporting requirements that leverage insurance information from carriers to spot uninsured motorists.

The challenge is that not each various state-run system is the same. Some don’t even have a state-run system. Each of which may have a different style or different data standards, present a significant burden and cost to insurance companies who have to comply with up to 50 different system. It is important to note that when insurance data verification systems do not significantly reduce the number of uninsured drivers, insured consumers may also be negatively affected because the compliance costs to the insurers may be passed on to consumers

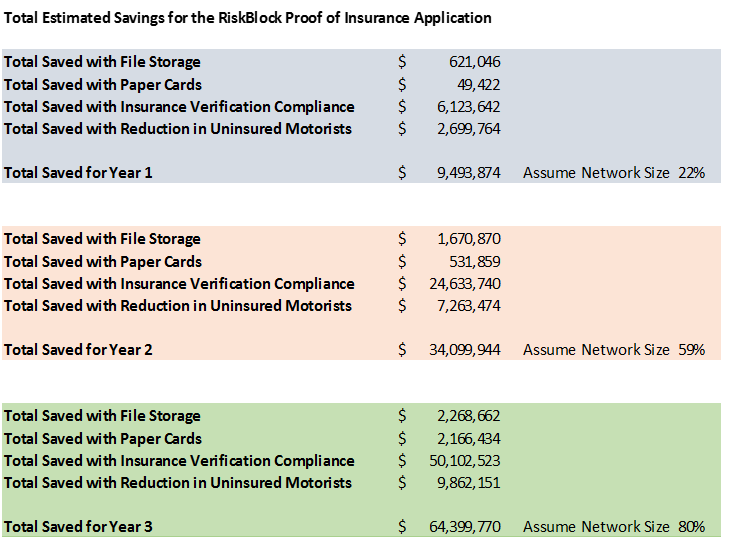

RiskStream’s POI blockchain application could ease the burden on the insurers to supply the data to those insurance verification systems but also for the regulators to correctly take in that information. Total estimated savings over three years is $64m

Finally there is a thought that uninsured motors could be reduced by implementing that technology which could in turn lead $9.8m savings in total over three years.

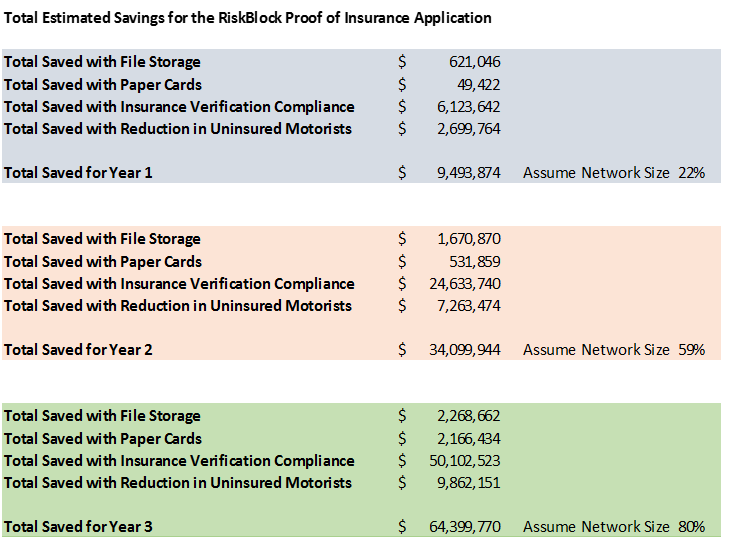

Total estimated savings for the RiskStream proof of insurance application

Source: https://medium.com/@schmidpat/examining-the-benefits-of-riskblocks-proof-of-insurance-and-first-notice-of-loss-applications-6a9e545fb734

Whilst RiskStream’s POI application has been running in prototype mode for a little while there isn’t at this stage sufficient data to collaborate the savings made in the above assumptions, however that is coming.

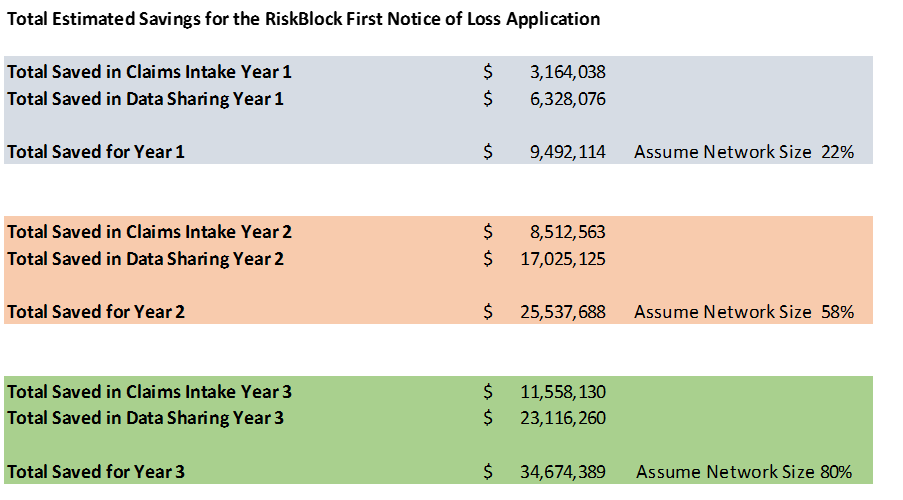

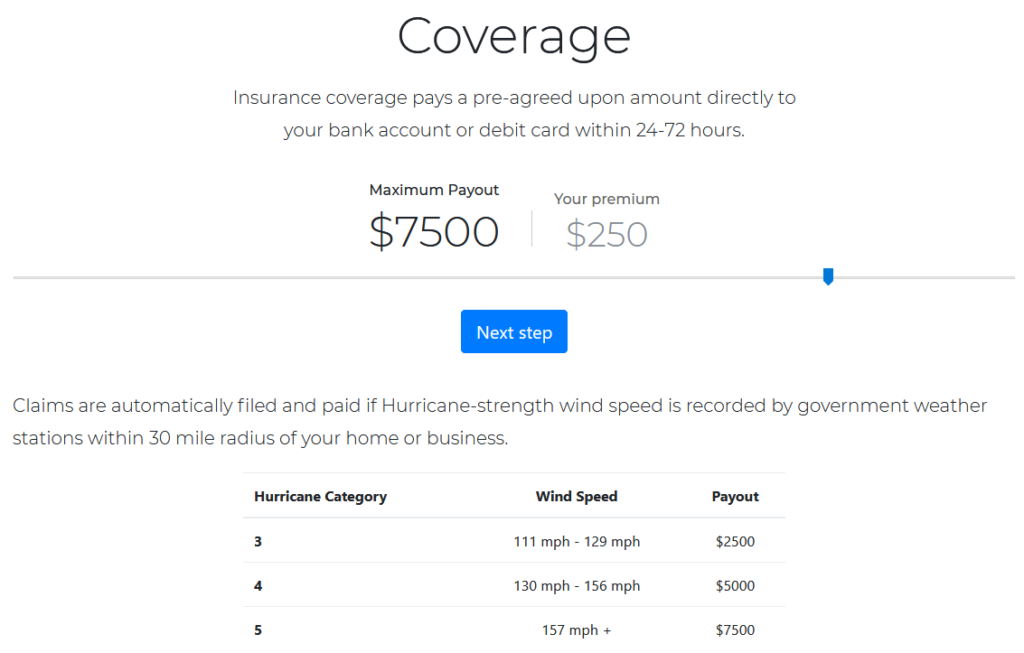

ROI on first notice of loss

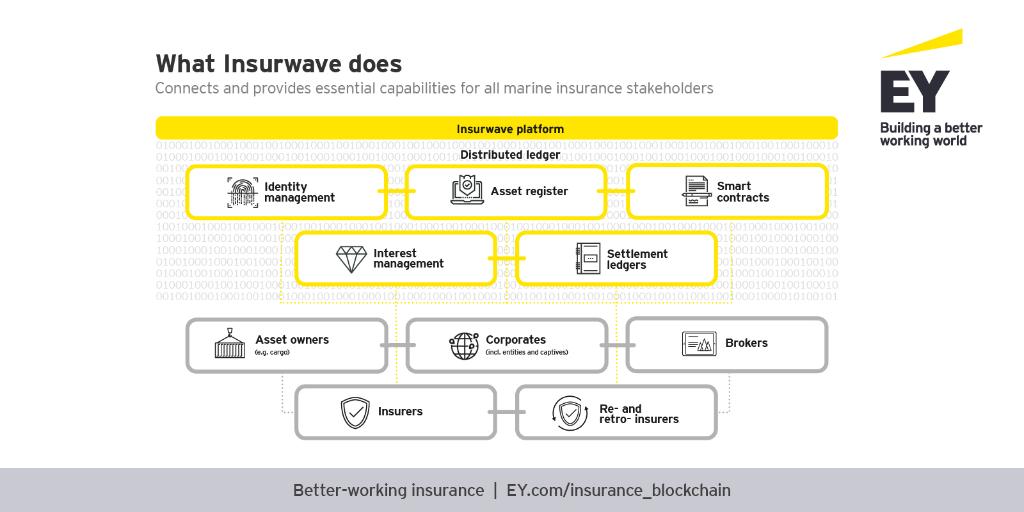

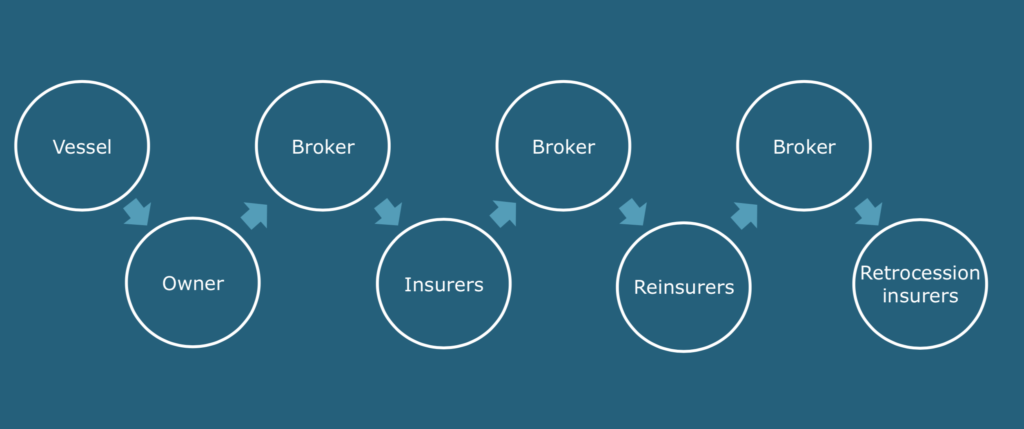

For first notice of loss (FNOL), RiskStream was looking at the exchange of information between a broker and a carrier and a carrier to a carrier.

According to recent auto claims statistics in the U.S., the number of auto bodily injury claims in a given year is 1.7 million, and the number of auto property damage claims is roughly 6.8 million, if you assumed they weren’t part of the same claim, the total is 8.5 million auto claims. This number is much, much larger if aggregating claims across lines of business and totalling them globally. Regardless of the line of business, the first notice of loss experience doesn’t meet expectations for consumers: it should be more streamlined, personalized, seamless, and fast. For businesses (insurers, brokers, etc.), the current inefficient, manual process involves a large amount of iterative information exchange, wasted time/resources, irreconcilable recording keeping, and redundant completion of various forms.

A decentralized ledger provides the means to share data from insureds and insurers to the various involved parties (such as other insurers and collision centres) in a trusted manner without an intermediary while maintaining security through permissions. This can greatly improve the process, cutting costs for insurance-related businesses, which could be passed on to consumers. Perhaps, the greatest benefit, however, is the insurer to insurer exchange that can occur. According to RiskStream members, each insurer to insurer call related to a first notice of loss claims takes 15 minutes of time and there are several of these calls. With blockchain or distributed ledger technology, a single source of truth could be referenced, cutting down from a time perspective or potentially eliminating these calls all together.

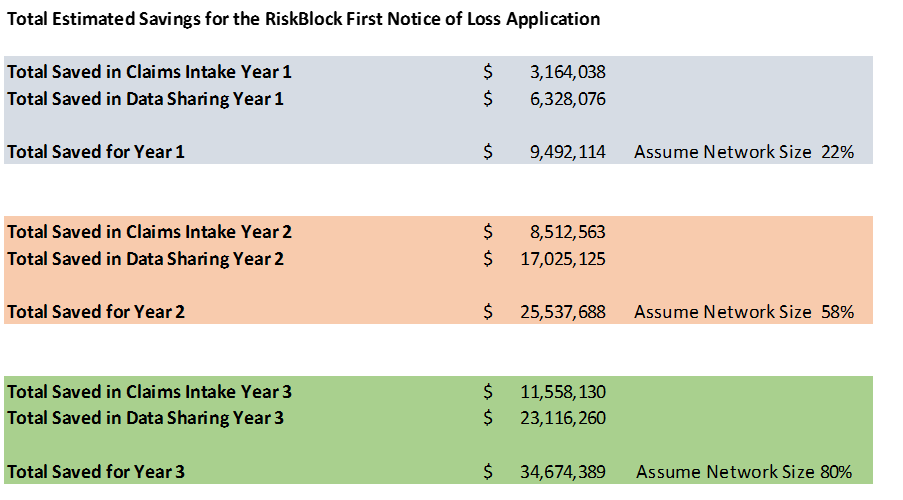

In calculating savings on FNOL, Patrick’s team looked at estimated savings on average time spent on fielding calls.

The average minutes saved on claim intake and data sharing are created into hourly estimates and multiplied by the estimated number of claims to arrive at the full potential hours saved with the DLT-enabled claims intake and data sharing processes. This process reveals that nearly 1.5 million hours could be saved annually in the US just on data sharing and claims intake alone.

If we assume a $30/hour rate, multiplied the potential for annual hours saved in both claims intake and data sharing, a total annual savings estimate is created. The estimate reveals a $14.4 million savings in claims intake is possible and a $28.8 million savings in data sharing is possible. This totals a $43 million in savings annually is possible.

Source: https://medium.com/@schmidpat/examining-the-benefits-of-riskblocks-proof-of-insurance-and-first-notice-of-loss-applications-6a9e545fb734

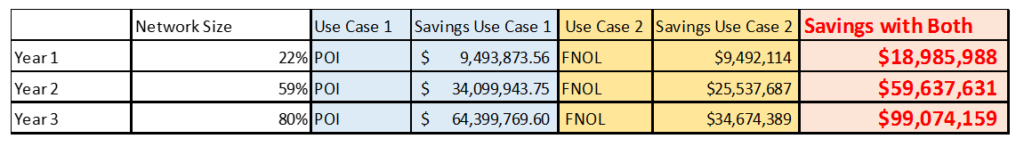

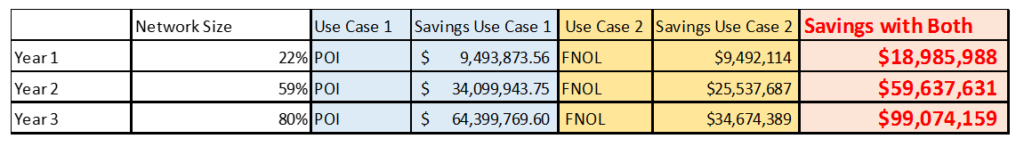

Total benefits of both RiskStream applications

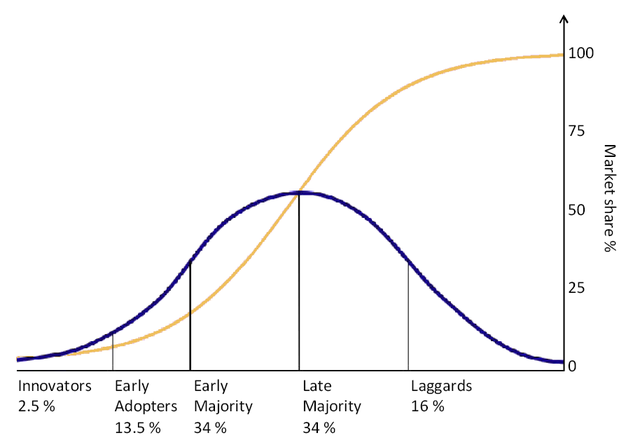

With a RiskStream, market share starting at 22% in year 1 and 59% in year 2 (note that today RiskStream Collaborative has 60% of members involved in the consortium) and 80% in the year 3, then they are looking to provide $99m worth of savings.

Source: https://medium.com/@schmidpat/examining-the-benefits-of-riskblocks-proof-of-insurance-and-first-notice-of-loss-applications-6a9e545fb734

LIMRA partnership – mortality monitor use case

Last September, RiskStream Collaboration entered into a collaboration with LIMRA, the professional body for the Life and Annuities sector, for developing a mortality monitor use case with a number of new insures.

As the Institue has an established network in the P&C space. When they were looking at the life & annuity retirement space, it was no brainer that LIMRA has the same type of standing in that area. It made perfect sense for the Institute and LIMRA, the professional body for the Life and Annuities sector, to work together to advance blockchain solutions across the entire industry.

Two use cases are being developed with LIMRA:

- Mortality monitor

- Licensing and appointments for life and annuities sector

For mortality monitor, RiskStream hasn’t yet developed an ROI model. However, there are nearly as many life insurance policies enforced as there is people living in the country. In 2017 there are 288 million life policies enforced compared to a population of 372 million. For families the death registration process is manual, ii paper intensive and the claims process can equally be challenging. DLT can reduce those inefficiencies and the frustration resulting from both the death registration and claims process.

If they were to build an ROI model for the mortality monitor use case they would look at the cost of state regulation that require life insurers to sweep their active and expired books of business periodically to check for policy holders who may have passed away whilst their policy was active. They could look at how DLT could be used to minimize regulatory compliance and drive improvements in customer satisfaction for the potential beneficiaries.

Top tips for building an ROI model

Keep in mind the amount of use cases and statistics made my numerous bodies such as:

- World Economic Forum report, entitled “Deep Shift Technology Tipping Points and Societal Impact” states that by 2027, 10% of GDP is going to be stored on a blockchain.

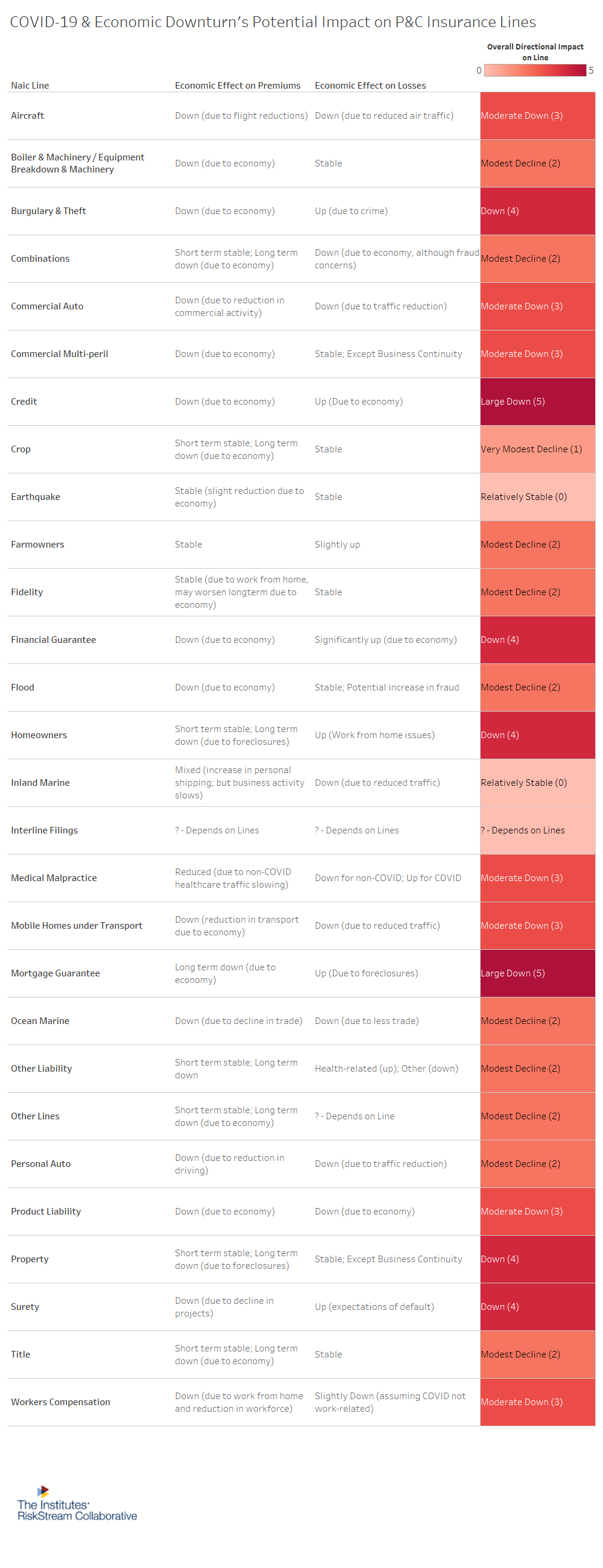

- Boston Consultancy Group in a report entitled “The First All-Blockchain Insurer” states that “blockchains could help the worldwide property and casualty (P&C) insurance industry reduce its combined operating ratio by 5 to 13 percentage points and generate upwards of $200 billion more in technical margin from its current gross written premiums.”

When looking at ROI it is important to note that if you have one or two use cases that can pay for the cost of developing a blockchain solution, then it would be beneficial to go ahead with it as there will most likely be other use cases that can leverage that blockchain solution.

Your Turn

Thank you Patrick for sharing some great insights on how to calculating ROI on blockchain. If you liked this episode, please do review it on iTunes. If you have any comments or suggestions on how we could improve, please don’t hesitate to add a comment below. If you’d like to ask Patrick a question, feel free to add a comment below and we’ll get him over to our site to answer your questions.

Our TOPPODCAST Picks

Our TOPPODCAST Picks  Stay Connected

Stay Connected